A wide term, "decentralized finance" (DeFi), refers to the transition away from centralized, traditional financial institutions and toward peer-to-peer financing made possible by decentralized technology based on the blockchain.

One of DeFi's most promising markets is lending, where fintech firms like Hodlnaut, BlockFi, and Nexo provide services while protocols like Aave, Maker DAO, and Compound Finance have enormous promise.

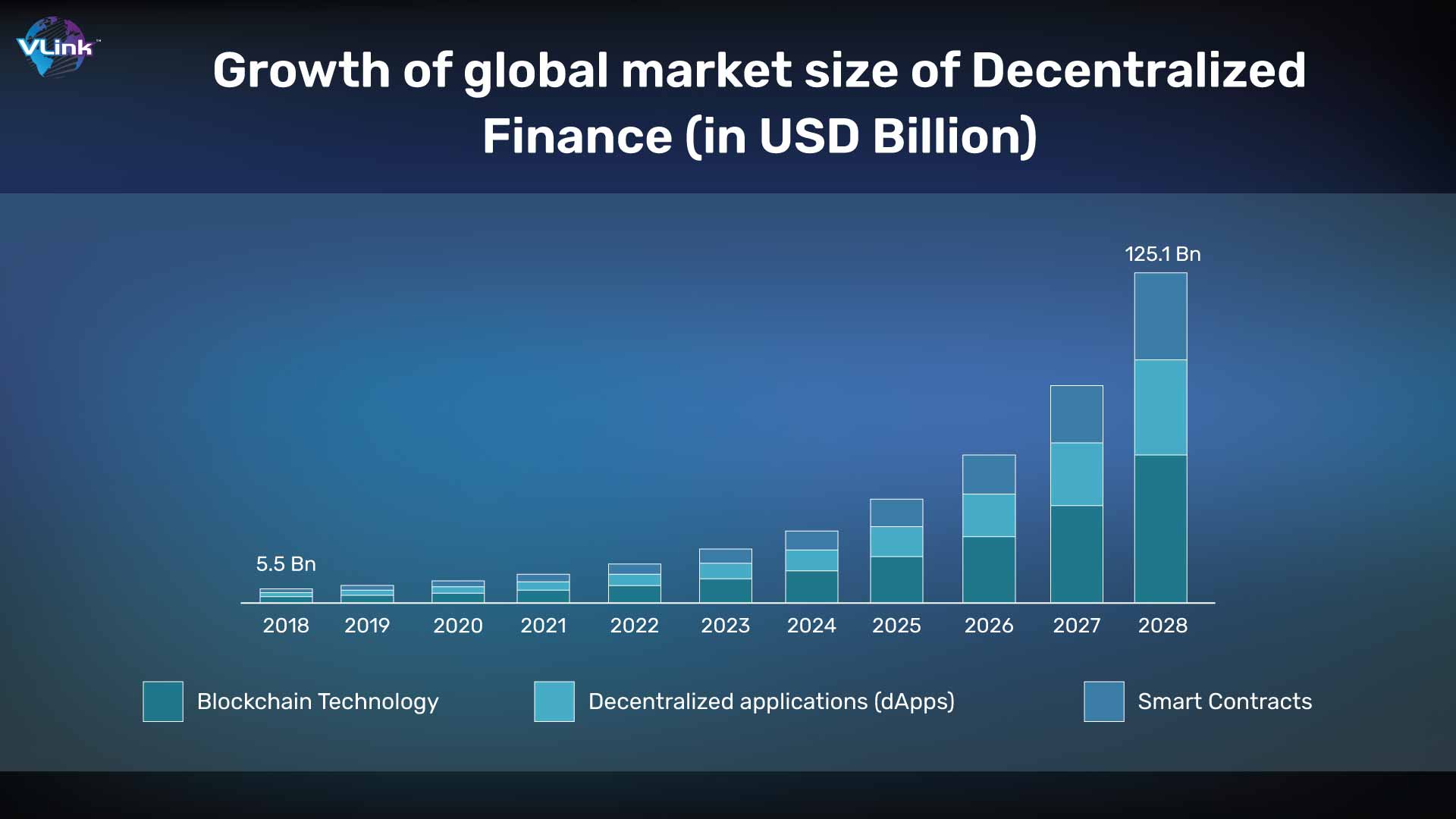

Defi has continued to forge ahead and, in a very short period, has garnered an astounding amount of cash despite the market being highly charged already. The Total Value Locked (TVL) in Defi protocols is currently at $20.46 billion, up from less than $1 billion a year ago, according to Defi-Pulse.

The loan and borrowing sector have just entered a new evolutionary stage called DeFi. Since the industrial period, conventional financial instruments—which grant loans based on credit and use dependable third parties as intermediaries—have been in use.  The introduction of the internet changed much of the rest of the globe, but this financial system's borrowing assets have largely remained the same. Businesses are now focusing on building modern financial software applications to be competitive in the industry.

The introduction of the internet changed much of the rest of the globe, but this financial system's borrowing assets have largely remained the same. Businesses are now focusing on building modern financial software applications to be competitive in the industry.

In this blog, we’ll talk about DeFi lending and it’s concepts along with its implementation, platforms and how VLink can help to deploy it.

What is DeFi lending?

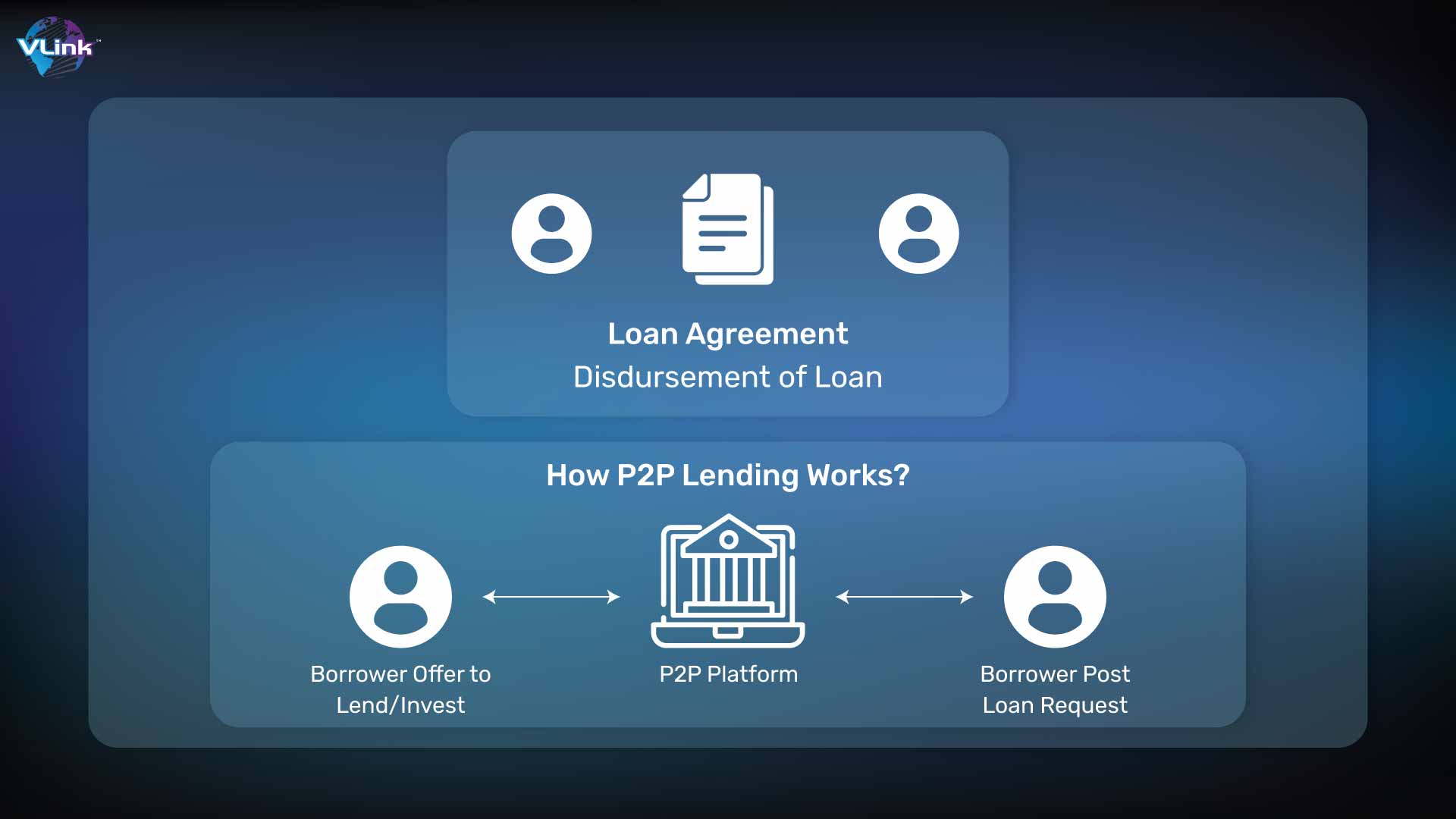

Borrowing in a peer-to-peer system with no banking involved is what decentralized finance (DeFi) is. But how can P2P lending exist without the bank using the collateral to safeguard the loan and liquidate it in the event of default?

Enterprises can use money to construct businesses that employ people and generate income, which can then be invested in other endeavors, if they have the time to repay the cash. The main factor is, of course, interest rates, which are paid by borrowers in exchange for the ability to access capital and repay it over a certain period of time.

The monthly payments become more affordable as the period lengthens, but borrowers will end up paying more overall in interest. Banks have long had a monopoly on lending.

How does DeFi lending work?

DeFi lending is a process where users deposit their cryptocurrencies in a liquidity pool. Then, other users from that bitcoin pool make loans available to them. These loans tend to have much higher interest rates than traditional loans, which is attractive to lenders. However, the downside is that borrowers may lose their collateral if they stop making payments.  Smart contracts allow users to pool their resources and make them available to borrowers. There are many ways to allocate interest to investors; therefore, it is recommended and worthwhile to research your preferred type of interest. The same is true for borrowers.

Smart contracts allow users to pool their resources and make them available to borrowers. There are many ways to allocate interest to investors; therefore, it is recommended and worthwhile to research your preferred type of interest. The same is true for borrowers.

Each pool will have a different approach to borrowing money. Therefore, borrowers must research the lending pools as well. Each lending pool has its own approach to borrowing money, so borrowers must do their part.

While AI being a utilized in transforming finance industry, companies moving towards DeFi can obtain a high jump in the industry.

DeFi Lending & Decentralized Finance

Finance that is decentralized is unique. It offers a way for people to keep control of their assets while earning income from them. Users may choose which money market to lend to and receive interest from based on the market's current annual percentage yield (APY) using blockchain-based smart contracts.

The lender will get a new token from that market that represents the value of the original borrowed token and the interest earned on it. There are no restrictions on who may use these lending pools based on their socioeconomic status or personal details like credit ratings.

This approach is ostensibly more equal than conventional financial organizations. Decentralized apps can give underbanked communities, who frequently struggle to get loans or create bank accounts, access to the financial system.

Benefits of DeFi lending

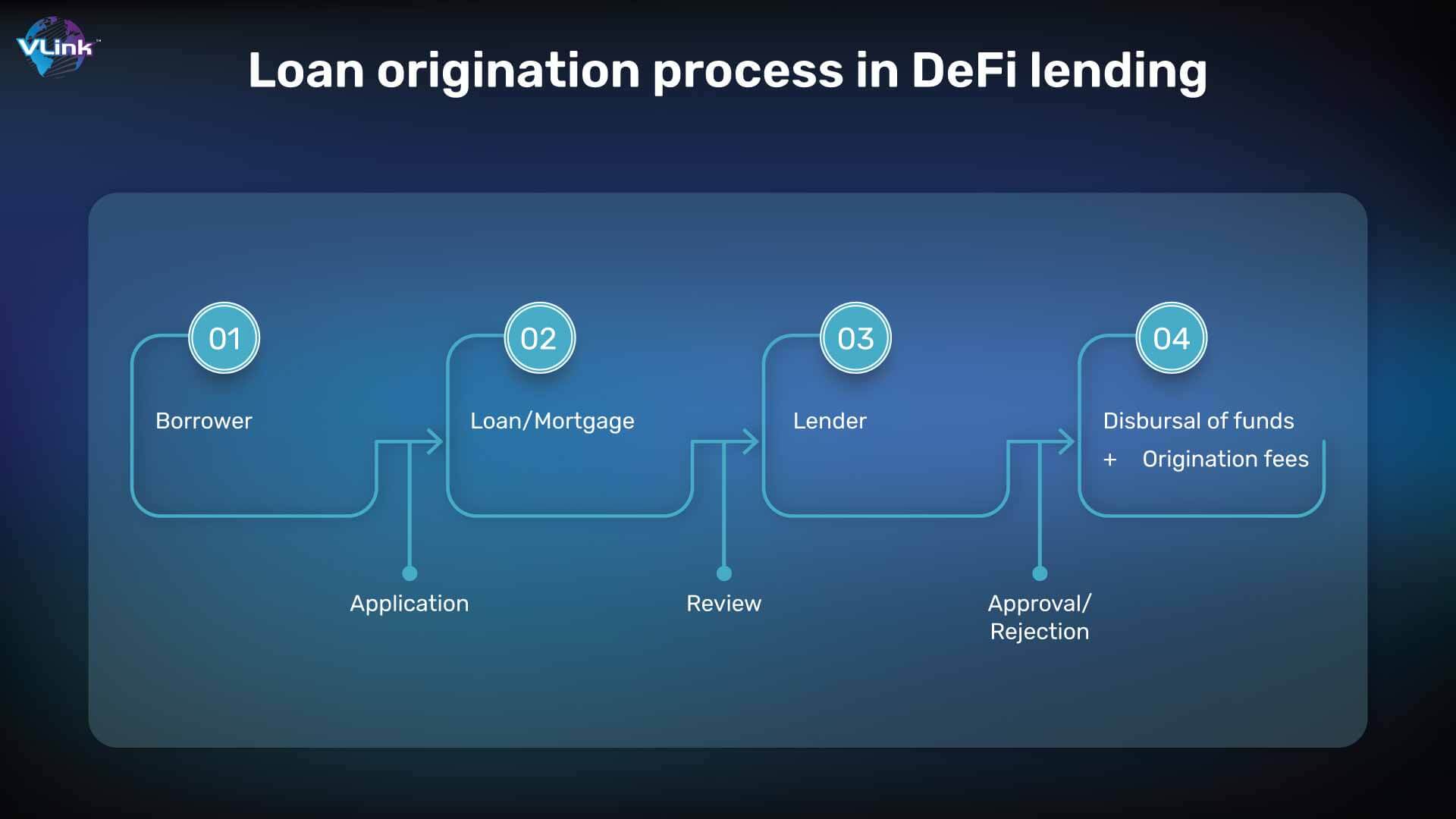

1- Accelerated loan origination

Digital lending platforms offer a range of advantages, including rapid processing time for loan operations, cloud-based services, fraud detection and analysis, and machine learning to calculate the most suitable loan terms and risk variables.  All of these technologies help to expedite the process, with lenders using electronic contracts to provide proposals as soon as approval is granted.

All of these technologies help to expedite the process, with lenders using electronic contracts to provide proposals as soon as approval is granted.

2- Programmability & immutability

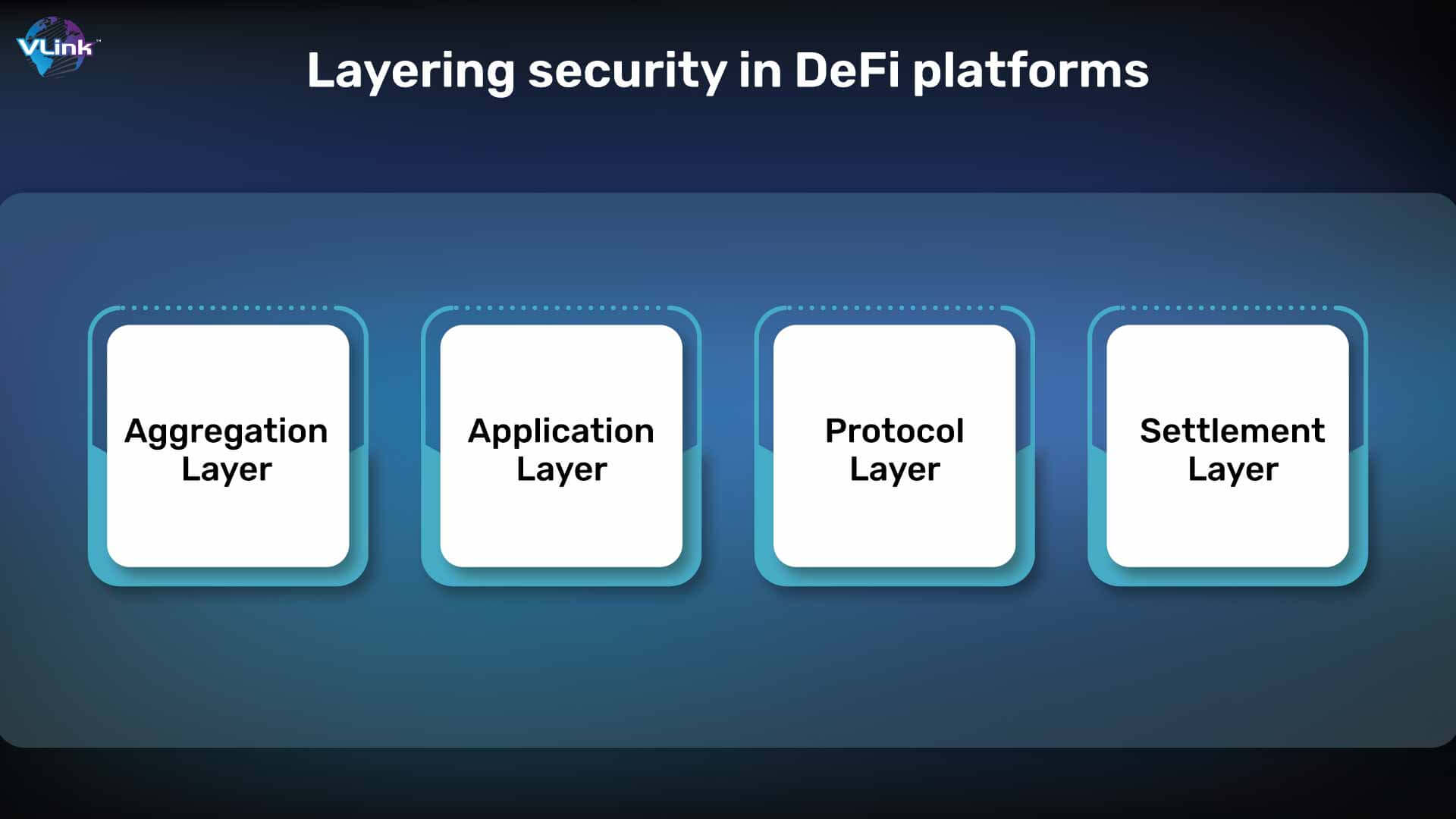

Decentralized architecture, provided by blockchain technology, allows for tamper-resistant data coordination while increasing security and audibility. Smart contracts are also highly programmable, allowing for the creation of new digital assets or financial instruments.

3- Interoperability & a focus on custody

When a connected software stack is utilized, defi protocols and apps complement and improve one another. Thanks to the use of Web3 wallets (like Metamask), participants in the Defi market keep strict custody of their assets and preserve control over their data.

4- Portfolio profitability & operational optimization

Analytics have the most potential to help lenders and borrowers in the digital lending process. By monitoring loan applications over a predefined period of time, lenders may predict and allocate resources appropriately to fulfill seasonal needs (a week, month, or year).

Analytics can also reveal information on credit levels, lending sources, demographics, and other topics. It might benefit the portfolio to comprehend how borrower characteristics and credit restrictions affect loan performance.

5- Permissionless

Defi lending made it possible for anybody with a cryptocurrency wallet to utilize Defi apps developed on Blockchain as it allows open, permissionless access without requiring a minimum amount of money.

6- Adherence to federal, state, & local laws

The rules that define efficient decision maintain a track of which rules were in effect at any one time, as well as who utilized them, when, and where. It acts as documentation and assurance that the lender abides by all relevant local, state, and federal regulations.

7- Transparency

Every transaction within the secure network is tracked and recorded along with users’ verification on the public Blockchain. Large-scale data analysis is made feasible by this level of transaction transparency, which also ensures that each network user has verified access.  Blockchain technology has a decentralized architecture that enables businesses to process and store data while maintaining its security and auditability.

Blockchain technology has a decentralized architecture that enables businesses to process and store data while maintaining its security and auditability.

Risks involved in DeFi lending

DeFi lending is undoubtedly a trustworthy way for cryptocurrency owners to generate passive income. But before you get started with DeFi loans, it's also crucial to be aware of the main risks. Three significant dangers that are connected to DeFi loans and have a significant impact on the DeFi ecosystem may be found.

1- Impermanent loss

For obvious reasons, one of the typical responses to inquiries like "What are the risks of lending on DeFi?" is impermanent loss. The main cause of temporary loss is the volatility nature of crypto coins. For DeFi lending, investors must lock their assets in liquidity pools, and the assets' price fluctuations after being deposited in the pool result in a temporary loss.

Threats of temporary loss from DeFi lending also result from knowing that DeFi pools heavily rely on arbitrage traders to set token values that are in line with current market value. When the value of the tokens in the pool changes, they might add new tokens with a greater value.

Therefore, arbitrage traders would contribute ETH to the pool in exchange for withdrawing LINK if the value of LINK decreased.

2- Flash loan attacks

Flash loans are essentially a brand-new sort of unsecured loan in the DeFi industry. In the world of traditional banking, there are two different loan types: unsecured loans and secured loans. Unsecured loans often have lower loan amounts and don't need any collateral.

Secured loans, on the other hand, are larger and need particular security, such as investments, real estate, vehicles, or other assets. Throughout the whole loan process, banks can assess a customer's reliability by using resources like credit scores and reports.

Flash loans, however, might pose a significant danger in DeFi lending because nefarious individuals might utilize them to manipulate the market. Additionally, some agents could utilize flash loans to pursue personal objectives by taking advantage of the weak DeFi lending regulations.

3- DeFi Rug Pulls

Consider the situation where someone is looking to rip out the rug while you’re standing firmly on it. What are the hazards of DeFi lending? Defi Rug provides one of the noteworthy responses, and it has lately been a significant focal point in the DeFi market.

Despite how intriguing DeFi seems, the ecosystem's rules are not entirely apparent. In order to lend their assets or buy tokens on platforms they are prepared to do so; investors must have a certain amount of faith in those platforms. Investors may yet be victimized by rug pull scams, which violate this kind of trust.

Most popular DeFi lending platforms

1- Maker

1- Maker

Maker is a distinctive Defi cryptocurrency loan platform that exclusively permits borrowing DAI tokens. The value of the stable coin DAI is tied to US dollars. Anyone with access to the Maker may create a vault, secure collateral like ETH or BAT, and then generate DAI as a loan against that collateral.

Through governance fees, which serve as the network's interest rates, it entices users to share in operating profits. Up to 66% of the value of the user's collateral may be borrowed in DAI. If the vault's rate drops below the predetermined rate, it will be subject to a 13% penalty and liquidation to get it back into compliance. The open market is used to sell liquidated collateral at a 3% discount.

2- Compound

For open financial applications, compound is a type of self-sufficient interest DeFi lending rates protocol. By depositing their cryptocurrency through lending and interest-bearing transactions, users may receive a passive income immediately.

The holders of Compound have the option to vote on certain choices, such as introducing additional assets and technically improving the platform. Depending on the amount they contributed to the liquidity pool, you will receive a CToken as a crypto lender.

3- Uniswap

Uniswap is a decentralized platform based on cryptocurrency exchange and being operated on Ethereum network. One of the main benefits of this platform is that users may trade smart contracts to completely manage their money. A default smart contract can also make it simple to list new currencies on the exchange. Using Uniswap, users can quickly exchange their ERC-20 tokens.

4- Aave

It was one of the most widely used Defi lending protocols when it was introduced in 2020 and is open source. A non-custodial liquidity protocol is used to generate income on assets that are deposited and borrowed. Interest rates are modified by the Aave algorithm according to supply and demand. It implies that the interest rate will increase with the number of aTokens a user has.

VLink can help you leverage DeFi lending.

The potential for defi lending to transform the whole financial system is great. The primary traditional financial services including payments, trade, investing, insurance, lending, and borrowing are all attempted to be decentralized.

Due to its involvement with this fascinating technology, defi financing has a lot of potential to completely alter the world of finance. You may take advantage of our fintech development services to create a DeFi lending platform and get ready for change in your company.

We have a team of experts who are working continuously on trending technologies like AI and Big Data. Collaborate with them and you’ll be able to establish a stable footprint in the industry.

Frequently Asked Questions

Platforms built on the Ethereum blockchain called Decentralized Finance (DeFi) protocols provide financial services including lending, borrowing, and trading. They make money in a variety of ways, including trading commissions, loan interest, and transaction fees.

DeFi lending has a lot of hazards even though it might be a secure way to obtain money. Investors must be aware of these hazards and take precautions to safeguard their money.

Visit a trusted lending protocol such as Aave first if you want to start lending on a DeFi platform. Join the DApp using your web3 wallet. You may deposit a variety of cryptocurrencies on lending services. A separate APY will apply to each cryptoasset.