Mobile Banking App Development: How to Create a Secure Bank App

Gone are the days when people had to visit the bank branch and stand in a long queue even for the most basic operations with their banking account.

4 minute

4 minute

Now, mobile banking apps offer convenience & freedom to handle the account from everywhere with just a click or tap, regardless of branch hours or location.

According to statistics, roughly 197 million people in the United States used digital banking services in 2021. And by 2024, this figure will grow to 217 million.

With this growing appetite for online banking services, many banks & financial organizations are embracing the utility of secure mobile banking app development for internal processes or customer use.

Chime, with 12 million active users & Varo, with 6.8 million accounts, are the most popular neo-banks in the United States.

- Why Is Mobile Banking App Development on the Rise?

- How to create a secure mobile banking app development?

- Future Trends in Mobile Banking App Development

- How much does it cost to build a secure & innovative banking app?

- Conclusion!

- How can VLink help you in mobile banking app development?

- FAQs–

It’s not a secret as to why developing a secure mobile banking app is increasingly important for business. It can boost your customer loyalty & minimize the overall cost of services.

How do you develop a secure mobile banking app for your business?

Looking for an experienced mobile banking app development partner? Schedule a free consultation with VLink!

You are thinking about this right now!

In this blog post, we curated a step-to-step guide on secure mobile banking app development.

First, let's start with why mobile banking app development is on the rise!

Why is Mobile Banking App Development on the Rise?

Both clients & banking institutions reap the benefits of mobile banking apps. People can use these apps for making transactions, handling their accounts & transferring amounts without any hassles.

On the other hand, investing in mobile banking software development gives a great advantage in cost reduction & seamless internal processes.

As it is a win-win situation for both sides of the process, mobile banking app development demands are on the rise.

As per Allied Marketing Research, globally, the mobile banking app revenue is set to reach USD 1,824 million by 2026.

A few benefits customers can enjoy with mobile banking apps are as follows:

- 24x7 accessibility

- Variety banking services

- Time-efficiency

- Increased security

- Effortless reviewing of transaction history and details

- Paying off loans online

- Remote Deposits

By investing in mobile banking app development, fintech firms can get the following perks:

- Paperless Record Keeping

- Reduced customer service costs

- Decreased operating expenses

- Great ROI

- Maximum value via push notifications

Impressive Statistics of Mobile banking app development 2023

Juniper Research says biometric authentication will secure over $3 trillion in digital banking transactions by 2025.

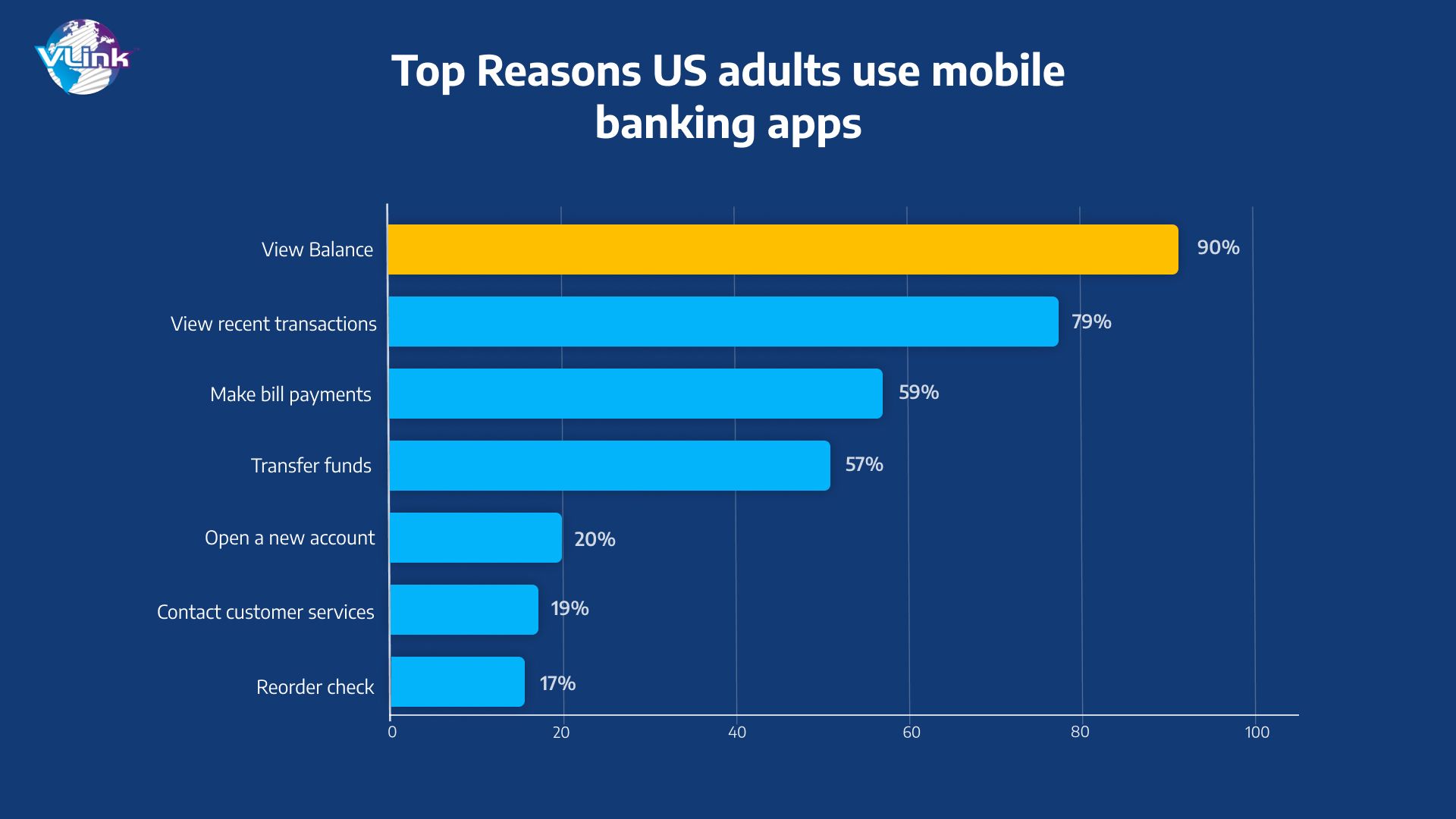

90% of younger people use smartphone banking, and more than 50% of elderly Americans prefer the same.

Open banking is predicted to reach a valuation of $128.12 bn by 2030.

Around 94% of smartphone users access digital banking services at least once a month.

Chatbots will help the mobile banking industry save nearly $7.3 bn in customer support costs by 2023.

McKinsey stated that mobile banking technology minimizes the cost of customer services by 50-70%.

How to Develop a Secure Mobile Banking Aap?

When building a secure mobile banking app, you must understand the features you need to integrate.

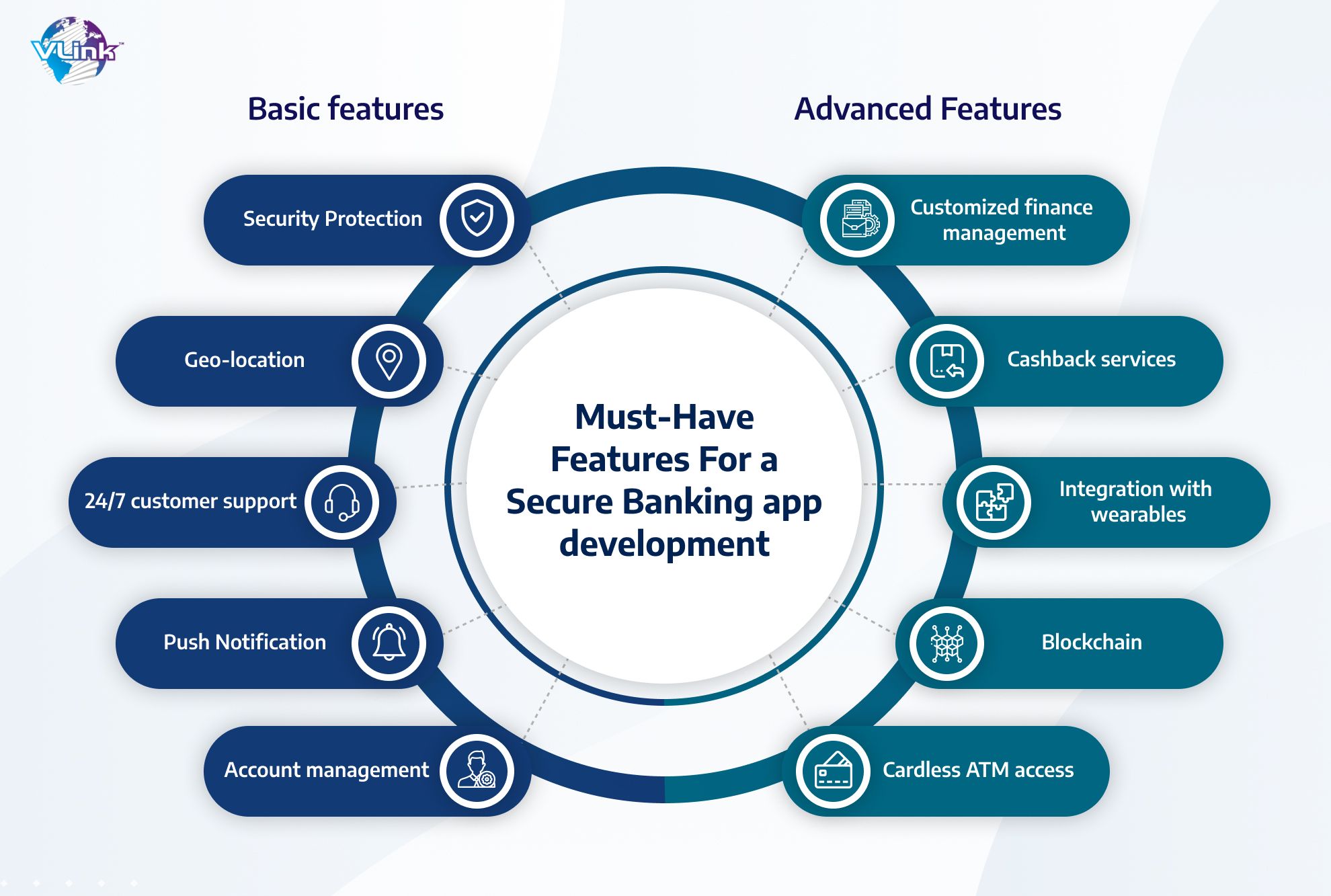

Must-Have Features for a Secure Banking App Development

Ensure you have a user-friendly and secure mobile baking app to stay ahead of the competitors. You will need to incorporate basic and advanced features in your software to do that.

Basic Features for Mobile Banking App Development

#1 – Advanced Security

In the fintech sector, security comes first!

Successful banking software must have robust security measures beyond simply logging in with a unique username or password.

Make sure your sign-in procedure is safe as well as quick and simple. So, it would help if you integrated multi-factor authentication and biometrics into banking apps.

Here are some ways to improve your banking app security:

- Add a multi-factor authentication feature

- Encourage the use of NFC-embedded SIM cards

- Use end-to-end encryption

- Incorporate fingerprint process

- Offer real-time text and email alerts

- Utilize behavior analysis

- Use secure access

- Utilize two-factor authentication via SMS for outside app payments

#2 - Geo-location

Thanks to the geolocation feature, customers can find an ATM or bank branch's location with information on the services provided, operating hours, and directions.

#3 - 24/7 Customer Support

Ensure your bank app allows customers to contact customer support quickly if required. Some users prefer talking to chatbots, and some to human assistants. You may leverage both methods reciprocally to increase your customer retention.

For example - Use a chatbot to answer simple queries and forward complex questions to human assistants.

#4 - Push Notification

Keep your customers up to date by sending banking alerts on account updates. But avoid being intrusive, as annoyed users can stop using your app.

#5- Account Management

Your banking app must help users check bank balances, track or record history, and analyze habits. You can also offer the audience the chance to set saving goals, create investment plans and automate regular payments.

Advanced Features for Mobile Banking App Development

Here are some advanced features you should incorporate to make your mobile banking app stand out.

#1 - Customized Finance Management

Adding valuable advice like savings and budgeting tips to your mobile banking app can be great. You can also add value to your online banking solutions by offering customized financial management advice.

#2 - Cashback Services

A perk like cashback services encourages bank users to make in-app payments. On top of that, cashback is a solid background for your loyalty program.

#3 - Integration with Wearables

The trend towards creating software for wearables is on the rise now. So, you can send custom notifications such as banking information, deliver alerts, and enable payments or transactions through wearable technology.

#4 - Blockchain

Incorporate blockchain features into your mobile banking app to improve its speed, accuracy, and security.

#5 - Cardless ATM Access

Allow your bank users to withdraw cash without needing a physical card. Instead, it requires account verification via a text message or a banking app call on the user's smartphone.

Once you know the main features required in bank application development, it's time to discuss some challenges you may face.

Secure Mobile Banking App Development Challenges

Security concerns depend on the most crucial challenges banking app developers must consider.

#1 - Regulatory Compliance

Primarily, your banking app should adhere to all required government regulations, have all its licenses, and comply with KYC.

Many FinTech organizations or institutions have few rules & regulations to follow, depending on where they operate.

Some of them are mentioned below:

PCI DSS (Payment Card Industry Data Security Standard)

Information security standards are used to handle credit cards safely worldwide. It must be adhered to by any service provider that conducts, processes, stores, or transmits credit card data.

CCPA (The California Consumer Privacy Act)

A law that is stated to enhance privacy rights and consumer protection for California, United States residents.

GDPR (General Data Protection Regulation)

A regulation for gathering and processing personal data from individuals in the EU.

PSD2 (Payment Services Directive2)

EU security laws for initiating and processing digital payments and protecting users' financial data.

SEPA (State Environmental Policy Act)

A set of regulations that allows electronic euro payments in the EU to be carried out faster, safer, and more efficiently.

Depending on your location, there might be more or less laws for your mobile banking app to adhere to.

#2 - Security

According to MarketWatch, more than 2 in 5 consumers still don't trust the security of their mobile banking app. It challenges banks or financial institutions that want a solution for its highest potential.

So, how can this issue be addressed? To make users feel secure while using your app, you should consider the following:

- Integrating encryption systems

- Encouraging users to create strong passwords

- Implementing multi-factor authentication

- Building your data storage infrastructure with different security measures

With these safety measures, you can't only improve the security of your mobile banking app but also make your consumers trust your software solution.

You can also turn to blockchain-based technologies to improve data safety.

#3 - User-Friendliness

A poor user interface and complex navigation can make banking apps worse. It ultimately can affect your company's reputation in the market. Thus, user-friendliness is of immense importance that you shouldn't avoid.

Your target audiences are all Millennials and Gen Z. According to Digital Banking Attitude Study by Chase, 99% of Gen Z and 98% of Millennials use a mobile banking app. So, ensure your app has clear visibility of elements and intuitive navigation logic.

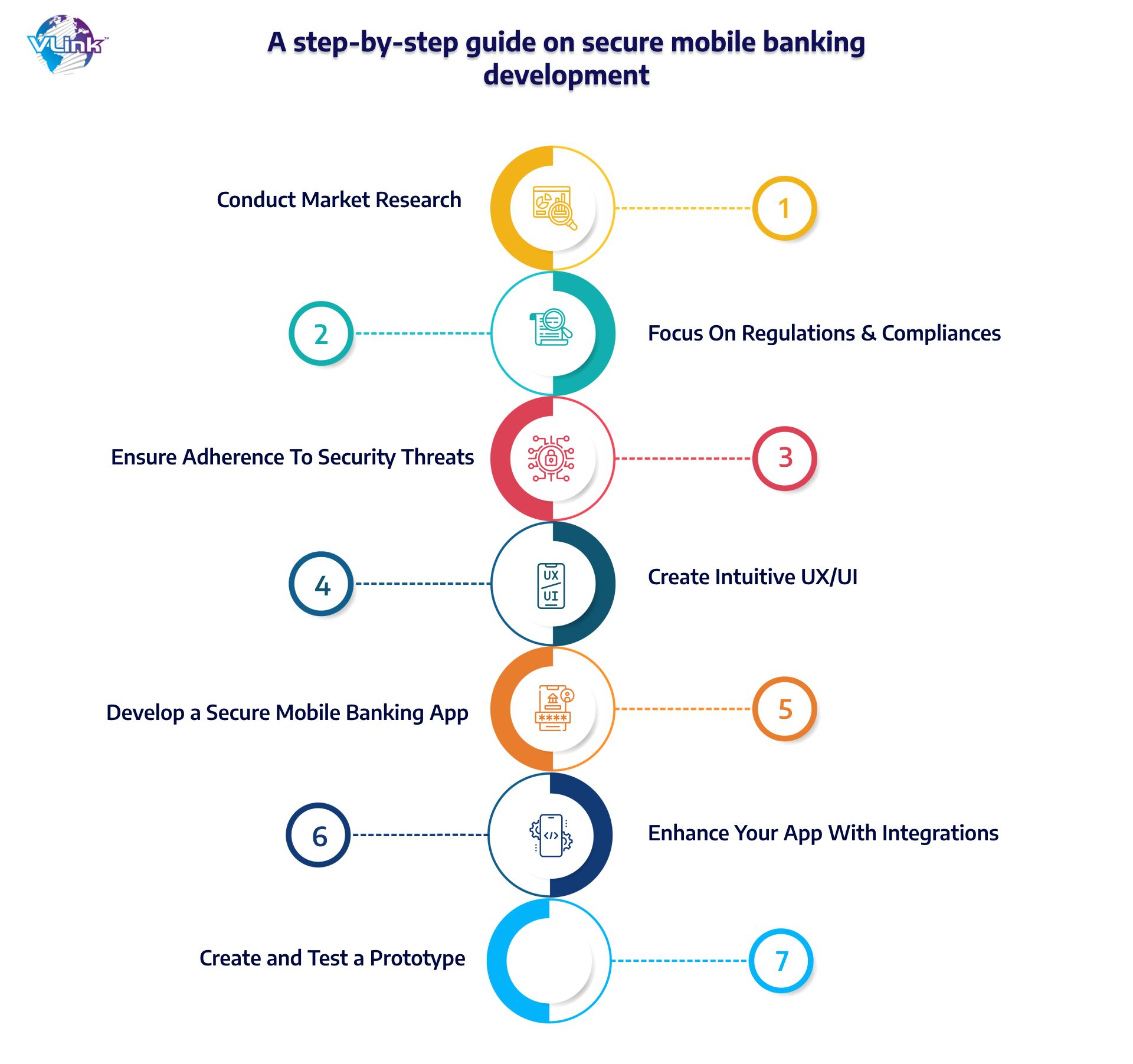

A Step-by-Step Guide on Secure Mobile Banking Development

Step #1 - Conduct Research

The first step in building a secure banking app is to conduct research. This phase includes analyzing the market, target audience, and competitors. You can use surveys, interviews, focus groups, online research, and reviews to do that.

- Market Research helps you understand your customers' needs and their desired features.

- Target Audience Research helps you determine your target audience's demographics and needs.

- Competitors' Research helps to understand what features your competitors are providing and how you can differentiate your software in the market.

Step #2 - Focus on regulations & compliances

A successful mobile banking app fully complies with all relevant laws and regulations. Failure to adhere to set regulations and compliances could lead to hefty fines!

To ensure compliance, you should clearly understand the relevant laws. You can consult with a dedicated fintech software development company.

Step #3 - Ensure Adherence to Security Threats

Ensure your banking app offers enough security for private and financial information. To make your finance software, you should incorporate the following features into your app:

- Two-factor authentication

- TouchID/FaceID

- Transaction limits

- Push notifications

Step #4 - Create Intuitive UX/UI

Delivering an intuitive, user-friendly, and simple UI/UX design is crucial in securing mobile banking app development. In this stage, you must create wireframes and prototypes and design all visual elements.

The look and feel of your app is essential for enticing your target audience and retaining them.

Here are some latest UI/UX trends you need to focus on:

- AI-based voice assistants

- Easy authorization

- Effortless account management

Step #5 - Develop a Secure Mobile Banking App

You can work with a software development outsourcing company if you want a banking app for your business quickly. By outsourcing your mobile banking software services, you can;

- Access the world-best IT talent

- Save time on hiring/firing in-house employees

- Increase flexibility

- Speed up your product's growth

Scalable and reliable banking app

At VLink promise to build online banking products and services accessible to your customers.

Discuss your mobile banking app idea!

Step #6 - Enhance your App with Integrations

Integrating your banking app with third-party services is an enticing feature that will make your software stand out.

Zelle, for example, helps users transfer money to other banks used by their counterparts.

Step #7 - Create & Test a Prototype

The final & most important step in your mobile banking app development cycle is creating & testing a prototype. In this stage, you must attract investments and test your idea with the target audience.

For that, you need to listen to your customer's feedback and incorporate the necessary changes before developing the final version of your app.

Best TechStack for Mobile Banking App Development

Here are the tools & technology stacks we use at VLink for mobile banking app development.

#1 - Native app development

If you build a banking app for Android or iOS, opt for native app development.

The best technologies for Android banking app development solutions:

- Java

- Kotlin

- Android Studio

- SDK

The best tech stacks for iOS banking app development solutions;

- Swift

- XCode

- iOS SDK

#2 - Cross-Platform App Development

For mobile app developers who want to use a single code base for several OS, cross-platform app development is the right choice.

Techstacks which help in building cross-platform apps are;

- React Native

- Flutter

- Xamarin

#3 - Hybrid App Development

Hybrid mobile apps - A blend of native mobile apps and web development.

Required tech stacks are;

- HTML5

- CSS

- JavaScript

- PhoneGap

Future Trends in Mobile Banking App Development

You might consider the following trends when developing a mobile banking app to capture the market's attention.

- Contactless transactions

- ATM connectivity

- Personalization

- Voice commands

- Chatbots

- Biometrics

- Big Data to prevent fraud

With these mobile banking app trends, you can attract more users and stay ahead of the curve.

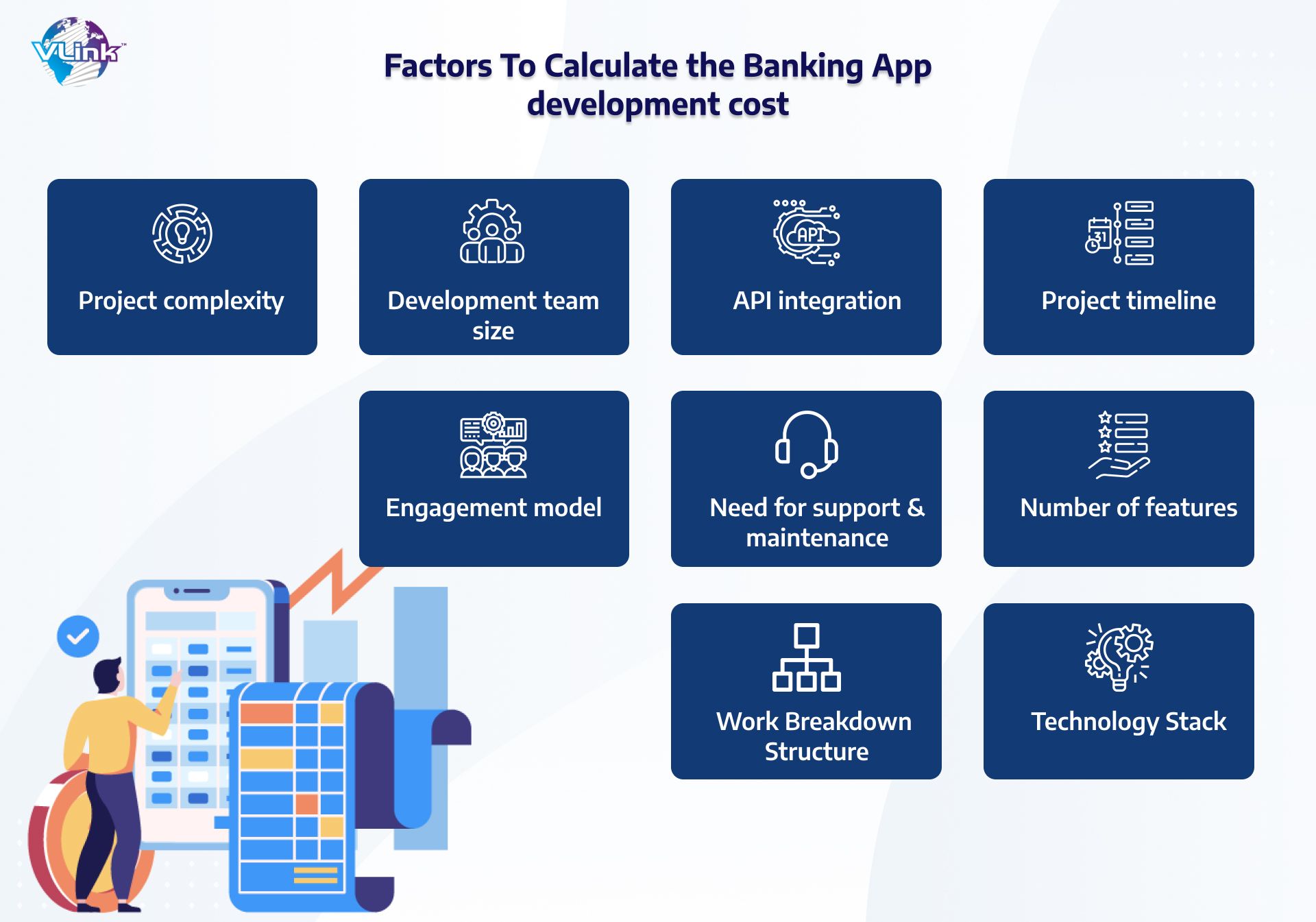

How Much Does It Cost to Build a Secure Banking App?

The mobile banking app development process cost can vary from $30,000 to $300,000.

It would help to consider several factors when calculating the cost of secure & innovative banking software.

- Project complexity

- Development team size

- API integration

- Project Timeline

- Engagement model

- Need for support & maintenance

- Number of features

- Work Breakdown Structure

- Technology Stack

Conclusion!

Mobile banking apps are becoming increasingly popular as more people use smartphones to handle finance activities. If you're considering developing a mobile banking app, following the steps outlined in this blog post are important. By doing so, you can create a secure & user-friendly app as per your customers’ needs. However, if you're unsure where to start, consider working with a reputable mobile banking app development company - VLink!

How can VLink Help you in Mobile Banking App Development?

As a dedicated fintech app development company, VLink offers a well-designed and secure mobile banking app integrated with a modern tech stack and extensive features per your business requirements.

We create mobile apps for banks & financial institutions that deliver impeccable user experience and make your business stand out. Our Android & iOS developers follow best practices and keep up with new security protocols to build dependable & secure banking apps.

To make our mobile banking software successful, we follow practices including proper planning, UI/UX design, building a banking app, and prototype & testing. In addition, we focus on recall event regulations and compliances to make banking apps secure.

Whether you want to upgrade your bank app or build a new one from scratch, Vlink can help!

FAQs–

Is it possible to build a banking app for iOS, Android, or both?

Yes, it’s possible to create a banking app for Android or iOS. But consider the customer niche you want to target and choose an OS based on their preferences.

What are the benefits of mobile banking apps?

The benefits of mobile banking apps are 24/7 access, money optimization, strengthened security, customized options, and many more.

How long does it take to create a secure mobile banking app?

It may take from 6 to 10 months to create an MVP. The exact duration depends on your project's size & conditions. Advanced features require a long time to develop.

What are the most popular mobile banking apps?

Citibank, Chime, Chase, Wells Fargo & Bank of America are some of the most popular mobile banking apps in the US.