With the growing number of e-commerce businesses, the demand for payment gateway development has also surged.

Statista states online payment transaction values are projected to grow by more than 15% between 2020 and 2025. Payment Gateway Market Size to exceed $161bn by 2032 at a CAGR of 20.5%.

Several market players can benefit from building software from scratch, from startups hunting an opportunity to suggest crypto payment gateways in an inappropriate region to merchants seeking ways to reduce payment service fees.

This blog will explore the complete payment gateway development guide, from its benefits, features, and costs to challenges and development steps.

What is a Payment Gateway, and How Does it Work?

Payment Gateway is a secure & convenient way for online transactions. An E-commerce application service provider (ASP) provides payment gateway software for e-businesses, online retailers, and traditional offline stores.

Other user include, banks or specialized financial software development company offering a e-commerce payment gateway integration solution.

How does it work?

A payment gateway links various stakeholders for financial operations. The people that initiate, process, and receive transactions include:

- Merchant

- Cardholder

- Issuing bank

- Card schemes

- Acquiring bank

A payment gateway completes operations in five steps, combining all these parties.

Step- 1

The cardholder initiates a purchase by clicking a "Buy Now" button on the merchant's site.

Step - 2

Now, the payment gateway ensures the transaction will be within the customer's credit limit or bank account balance.

Step-3

In this stage, the payment gateway processes the transaction by sending encryption card information to the card schemes.

Step - 4

The card schemes confirm the payment, and the gateway sends the details back to the merchant's website to complete the transaction.

Step - 5

The e-commerce payment gateway sends the information to the receiving bank to move money from the customer's issuing bank account into the merchant's account.

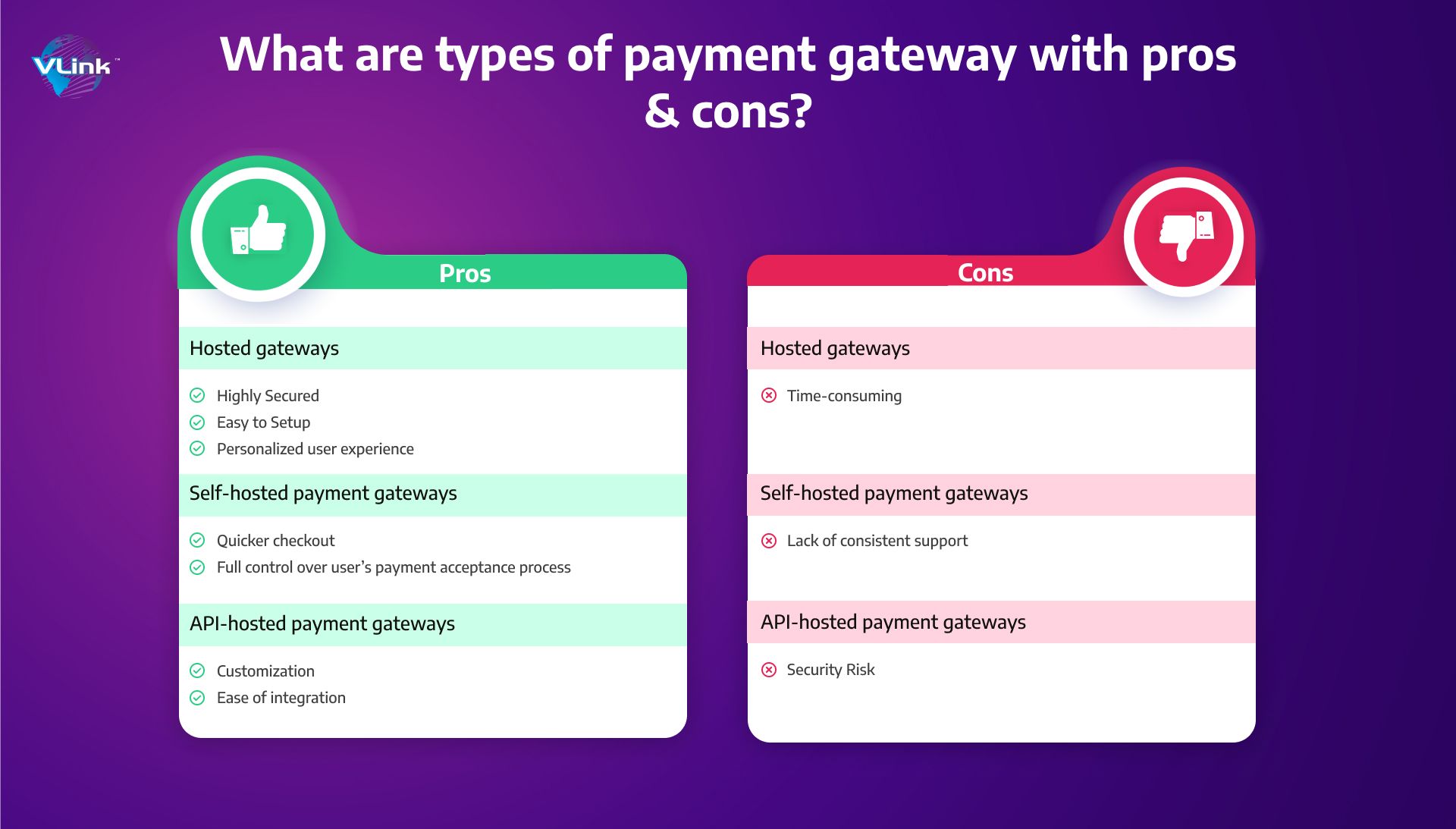

Types of Payment Gateway and Pros & Cons?

There are three types of payment gateway.

- Hosted gateways

- Self-hosted payment gateways

- API-hosted payment gateways

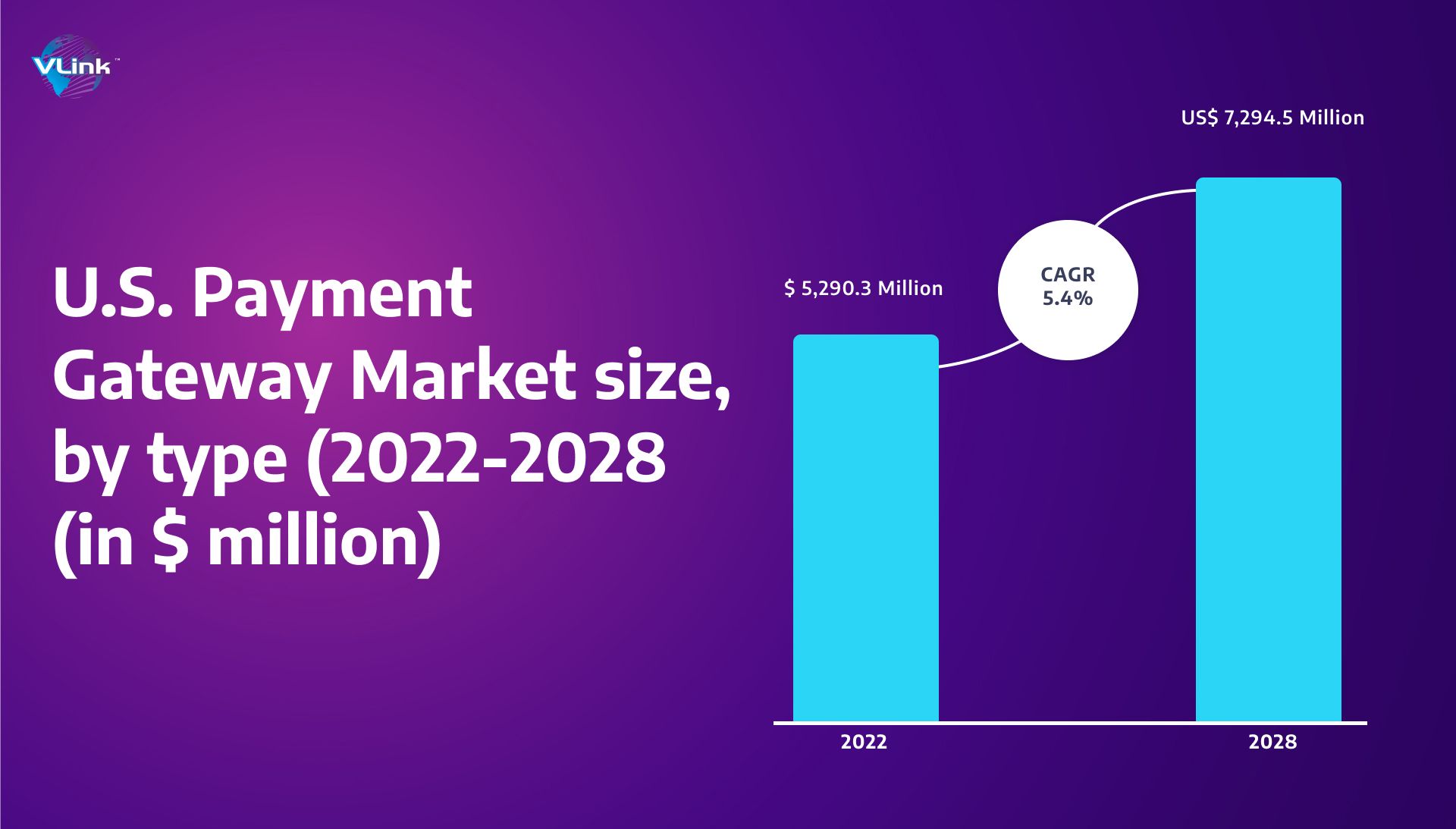

Market Overview of Custom Payment Gateway Development

Here are some stats about custom payment gateway development that will surprise you!

- In 2022, North America accounted for the highest revenue share of 38% in the market.

- By customers, the retail and e-commerce industries influence gateway with a 28% market share.

- Payment Processing Solutions Market size was valued at $65.6 bn in 2022 and is projected to reach $198 bn in 2032.

- The commercial Payment Cards Market is expected to reach around $ 33.69bn by 2032.

- Contactless Payments Market is projected to be worth $ 90.6 bn by 2032 from $ 22.4 bn in 2022.

Benefits of Payment Gateway Development

23% of consumers avoid shopping carts because of time-consuming checkout and complex user-interface design. Payment gateways can resolve most of these issues. This is why plenty of business owners are turning towards custom gateway platforms.

Here are some other benefits you will get from a customized payment gateway development solution:

Custom Functionality

A third-party payment gateway doesn't support multiple currency transactions. It may limit your transaction process. However, with a customized payment gateway development, you can integrate several functions you want without paying high fees or restricting your abilities.

Minimized Fees

A personalized payment gateway integration system reduces costs and fees for transactions.

Competitive advantage

A personalized online payment gateway's demand is rapidly growing in today's digitization market. So, if you build a unique product, you will surely have more relevant customers.

Extra Profits

You can sell your custom payment gateway as a product or charge user sign-up and transaction fees.

Compliance

Custom payment software development allows you to comply with local and global regulations for maximum data security.

Thus, creating a custom crypto payment gateway may be profitable for IT enterprises wanting to enter the fintech market.

Must-Have Features for Payment Gateway Development

Fraud protection

Every merchant wants a secure & protected gateway to gain the client's trust. A fraud detection system protects merchants and consumers from financial loss and safeguards the payment ecosystem's integrity.

This feature uses a combination of rule-based systems, ML algorithms, and behavioral analytics to identify fraudulent activities and patterns.

Tokenization

This feature replaces confidential data (e.g., IBAN) with random alphanumeric tokens. Then, only the processor can handle the transactions. So, when hackers attack your gateway, they can't steal or damage confidential data.

Recurring Payments

Configure recurring payment models through dashboards, virtual terminal commands, or APIs. This feature is suitable for subscription-based providers that request payment monthly or annually.

A gateway system operates recurrent transactions when customers enter their card data and agree to be charged automatically.

Seamless Integration

Easy integration with several payment processors allows gateway system owners to offer several options to end users.

Make sure your CRM system should be able to interact with your payment gateway seamlessly. To support this integration, you have a clean and robust API.

Hosted Payment Gateways

With a hosted payment gateway implementation, you can reduce the threats and limit your liabilities. These third-party checkout systems redirect buyers to the payment service provider's page, improving security.

Stability

Mind the time zones if you plan to build payment gateway software for global customers. Ensure your gateway is available 24/7/365; otherwise, you risk losing some share of clients.

A paper published by the Asian Bureau of Finance and Economic Research in May 2022 observed that "transaction through PayPal reduces by approx. 10% during PayPal disruption," which results in a massive loss of revenue.

For providing any-time support to your customers, you can use chatbots that serve as FAQs.

Virtual Terminal

Merchants or sellers can now accept payments without physical credit cards thanks to a virtual terminal. It means buyers can make payments via a mobile device. To turn your desktop into a virtual POS terminal, connect it to a cloud-based service without installation.

Multi-Currency Support

Geographics do not restrict digital transactions. Thus, users in different countries might use your payment gateway system.

So, a multi-currency payment gateway development would be helpful to make your gateway software as comprehensive as possible.

5 Most Popular Payment Gateway APIs with Their Key Features & Prices

#1 - Square - Best for Breadth of Features

Square online payment gateway allows merchants to accept payments in their online store.

Pros:

- Predictable flat-rate pricing

- No long-term contract

- Enables omnichannel selling

- Excellent public documentation

Key Features:

- Invoices

- Inventory control

- Customer management

- Loyalty programs

- Booking

- Team management

- Proprietary gateway

Square Pricing:

Square offers a new subscription-based service.

- Square Appointments: $0 – $69/month

- Square For Retail: $0 – $60/month

- Square For Restaurants: $0 – $60/month

- Square Invoices: $0 – $20/month

#2 - Stripe - Best for Developer Resources

Stripe offers several APIs to power online payment processing & e-commerce solutions for all sizes of businesses.

Pros:

- Predictable flat-rate pricing

- No long-term contract

- Excellent developer resources

- Excellent support for worldwide currencies

Key Features:

- Credit & debit cards

- ACH

- Google Pay

- Apple Pay

- Invoices

- International currency support

- International payment method support

- Account routing by currency

Stripe Pricing:

- Premium support: $1,800/month

#3 - PayPal - Best for Secured Payment

This online payment platform offers many business-centric tools, including a comprehensive API.

Pros:

- Fraud Protection

- The flexible way to shop

- Faster, & more secure

Key Features:

- Invoicing

- Report Generation

- Recurring Subscription Payments

#4 - Helcim - Best for Easy Scaling

Helcim offers online and in-person payment processing services. It's known for its arranged pricing that provides high-volume merchants with lower pricing.

Pros:

- Transparent interchange-plus pricing

- No long-term contracts

- Good developer resources

- Accepts international payments

Key Features:

- Credit & debit cards

- ACH

- Google Pay

- Apple Pay

- Invoices

- Inventory management

- Support for Canadian payment methods

- Customer management

- Card value

Helcim Pricing:

- Helcim offers interchange-plus pricing with no monthly fees.

#5 - Authorize.Net - Best Payment Gateway

Simple yet effective, Authorize.Net allows developers to create custom ways to process payments & design a checkout.

Pros:

- Versatile standalone payment gateway

- Excellent customer service

- Live console available in the documentation

- Excellent developer resources

Key Features:

- Credit & debit cards

- ACH

- Google Pay

- Apple Pay

- Customer information management

- Syncs with Quickbooks

- Advanced fraud detection

- International currency support

Authorize.Net Pricing:

- Monthly fee: $25

How Can Your Business Benefit from Payment Gateway Development?

Payment gateway software has several benefits for easy product optimization. However, several things can give your business a competitive advantage.

- The easier and faster payment process

- Higher security and regulatory compliance

- Different types of transactions are supported

- Advanced Purchasing User Experience

Challenges in Payment Gateway Development

These major digital payment operational challenges affect the merchant and buyer alike. Here's a look at some of the main issues faced by businesses when creating payment gateway development:

- Credit card frauds

- Chargebacks

- International currency acceptance & conversion

- Integration

- Compatibility

- Security

Step-By-Step Guide on Payment Gateway Development

As a finance business owner, delivering a secure and seamless customer payment experience is essential for success. Although there are several third-party payment gateways, creating a custom payment gateway provides a customized solution that meets your business needs.

Creating a payment gateway from scratch

- Discovery Phase

- Design Phase

- Development Phase

- Testing Phase

- Integration Phase

- Launch & Maintenance

Besides the payment gateway development phase, several other things should be considered before building gateway software.

What Else Do You Need to Consider for Payment Gateway Development?

Legal & Security Requirements

When developing any finance solution, it's essential to mind regulatory mobile banking compliance requirements & security.

Each country has different local & international legal standards. Ensure your software meets your country's regularities to avoid fines and penalties.

Payment gateways integration must comply with the Payment Card Industry Data Security Standard (PCI DSS), EMV 3-D Secure, & P2PE Encryption to ensure the security of sensitive data.

Integration

Payment Gateways must be integrated with the merchant's platform for seamless transactions.

There are two options available:

- Redirecting

- PSP integration via API

Remember that users want to avoid dealing with credit card credentials while in waiting lines. PSPs can only support one option described above.

So, consider add-ons and side themes into your gateways whether you want an internal or external checkout page.

Payment Processing

Ensure your payment gateway system has a reliable payment processing system to allow transactions quickly and efficiently.

Real-Time Transactions

Today, most merchants and business owners seek options offering real-time claims settlement.

So, try to follow an effective development method for real-time transactions without compromising security.

Required Technology Stack for Payment Gateway Development

In payment gateway development projects, developers usually rely on the following tech stack for payment gateway development:

Databases/Data Storages

SQL

- Microsoft SQL Server

- MySQL

- ORACLE

- PostgreSQL

NOSQL

- MongoDB

Cloud Databases, Warehouses & Storage

- AWS

- Azure

- Google Cloud Platform

Back-end Programming Languages

- .Net

- Java

- Python

- NodeJS

- PHP

- GO

Front-end Programming Languages

Languages

- HTML

- CSS

- JS

JavaScript Frameworks

- Angular

- React

- Vue.js

Mobile

- iOS

- Android

- React Native

- Flutter

Real-Time Data Processing

- Kafka

- RabbitMQ

- Amazon Kinesis

DevOps

Containerization

- Docker

- Kubernetes

Automation

- Ansible

- Terraform

CI/CD Tools

- AWS Developer Tools

- Azure DevOps

Monitoring

- Elasticsearch

- DATADOG

- Grafana

Cost Evaluation of Payment Gateway Development

The cost of personalized payment gateway development relies on its complexity. Modern solutions require a lot of time, team, and substantial investment.

You must first know the required features, tech stack, team, and deadlines to set the budget.

Usually, custom payment gateway software integration costs $200,000 or up. Plus, you may also pay for software maintenance & support services.

The Final Thought!

Whether you are a business owner, a large merchant, or a tech company, it's worth the investment. Simultaneously, payment gateway development is a rigorous process. So, it would help if you considered various technical, security, and regulatory requirements to make it stand out.

Consider VLink as your Payment Gateway Development Partner

Whether you want a payment gateway from scratch or improve your existing one, VLink is the right place for you!

We are specialized in finance development services. With many years of experience, we have helped thousands of clients unlock their digital potential.

From P2P payment software development to payment gateway integration, our team has the technical expertise and the mastery of the concepts that can take your business to the next level.

Contact us today for more queries about payment gateway software integration and development!

Frequently Asked Questions

Payment gateway software is useful for e-commerce businesses, online marketplaces, subscription-based services, and other providers.

The business payment model is based on the % or fixed fee that the merchant pays from each transaction. The charge amount relies on the transaction mode.

The payment gateway development process can take several months, a year or more. But always remember your gateway deals with sensitive financial information. So, you need to focus on quality and security over speed when building gateways.