Integrating Artificial Intelligence (AI) In Insurance Apps

The tech-driven shift of industries has made the insurance businesses embrace the adoption of Artificial Intelligence (AI). It is becoming more and more integrated with the core business functions, such as underwriting, claims management, policy distribution and a lot more.

5 minute

5 minute

As the insurance businesses focus on building and maintaining quality experience for their customers, insurance AI is redefining the approach through which they serve solutions to the consumers. And the positive impacts can be seen with

- Enhanced decision making

- Higher productivity

- Lowered expenses

- Optimized the customer experience.

But how is this all happening? What factors are driving AI for insurance businesses? How will we see artificial intelligence in insurance for the next five years? And what can you do to leverage AI in the insurance business? To get the answers right, let’s begin with the pain points that will be shielded by AI in the insurance industry.

Table of contents:

1. Introduction

2. Major challenges in Insurance sector

3. Benefits from AI in Insurance Industry

4. Different Roles of AI in insurance sector: Policies-wise categorization & implementation

5. Top Insurance Companies That Adopted AI (& Got Success)

6. What future holds for Insurance AI Apps?

7. How VLink can help you integrate AI in insurance applications?

Major challenges that Insurance AI overcomes.

1. Risk management

More accurate risk assessments mean more appropriate premiums. In an industry where the largest difference between insurance companies is not their products but their prices, a more individualized exposure model could make a big difference.

AI and Machine learning, specifically natural language understanding (NLU), enables insurers to pore through more abstract sources of information, such as Yelp reviews, social media postings, and SEC filings, pulling pertinent information together to better assess the insurance carrier’s potential risk.

2. Human error prevention

Current insurance distribution channels are a bit complex and wind up with traditional methods. The distribution chain in the insurance industry and complex, as there are many people involved in reviewing information between the insured and the service provider. This manual work can lead to human errors, resulting in slow processing throughout the hierarchy.

AI in insurance will help to reduce the time consumption using smart algorithms, which help in analyzing the data, reviewing the required sanctions, and maintaining the accuracy. Moreover, there will be less data redundancy – ensuring that insurers don’t require to upload documents repeatedly at every stage.

3. Claims processing

Processing claims can be a difficult and time-taking task. Insurers make every possible effort to provide the best experience to the customers, but complexity in claims assessment makes them face certain hurdles. They need to review policies, read crucial details and then must make decisions to process claims. Surprisingly, AI can handle all these operations quite easily.

Integrating AI in the insurance process can help in forecasting the potential amount to be involved in the claims by analyzing the customer’s case – premiums, transactions, and past claims. Insurers then verify the results and ease the customer journey by settling the amount, concluding that both customers and insurers leverage a quality experience.

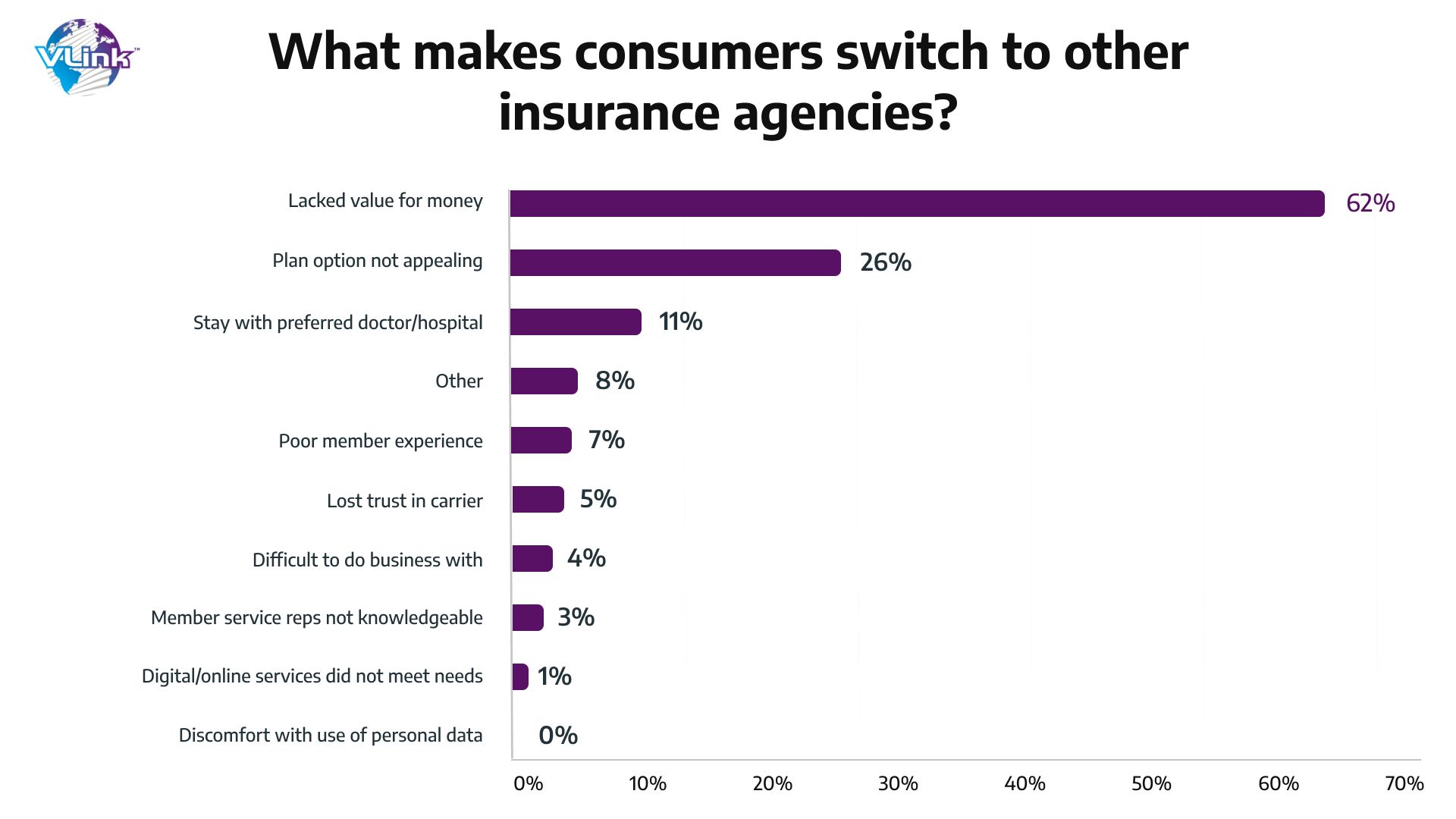

Here is a report from Accenture that shows the core reasons for the loss of customers (switching to other insurance agencies). And all this happens when the above-mentioned pain points weren’t handled seriously!

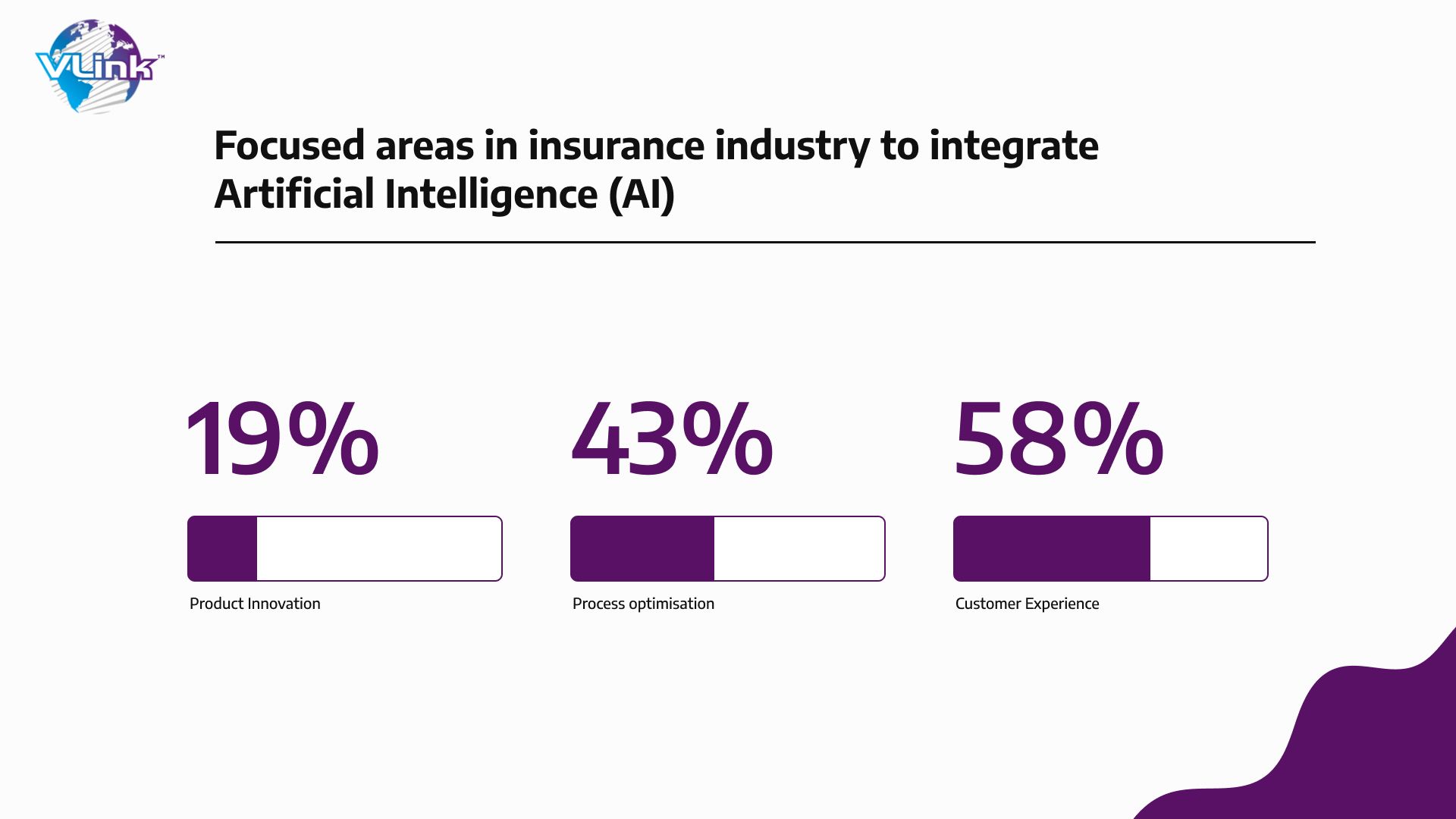

The impact of AI in the insurance sector has brought several areas into focus, which can be optimized for better performance. Interestingly, they can utilize AI to benefit their business for more profitable outcomes. Let’s have a look:

Benefits from AI in the insurance industry

- Enriched data pool

Integrating AI in insurance applications eases the collection, processing, categorizing, and storing of customers’ data more efficiently. Businesses will be able to create more sophisticated models for predictive data management.

AI-based applications can perform underwriting with complete accuracy by analyzing gathered data. The algorithms can collect valuable insights from credible sources and provide data-driven solutions.

- Fraud detection & prevention

Smart insurance AI apps can tackle fraud and prevent businesses from potential losses. The smart algorithms help in addressing the false claims and block them while notifying the details to the insurers. As a result, the analytical behavior of AI affects the decision-making process for judgements on fraudulent claims.

Moreover, the technology identifies the patterns of applying or requesting claims by recognizing the actual data and alerts insurers if there is something suspicious. These actions take place within minimal time consumption and block the activity to enhance fraud protection.

- Making operations optimized & efficient

With enhanced decision-making, predictive data analytics, and algorithmic behavior on claim processing, integrating AI in insurance business applications will result in increased efficiency. It can make operations run smooth and easier to execute even if the cases are high in numbers and need quick reviews/approvals.

Moreover, AI-powered insurance apps can speed up product upselling among potential customers. These applications can utilize resources to review information quickly, mapping the customer requirements, and reduce repetitive process.

- Frictionless customer journeys

Insurance businesses require keeping their customers hooked with quality experience. If they don’t provide satisfactory results, most customers look to switch to other insurers. Insurance AI apps can help to analyze issues by reviewing and understanding feedback and complaints and offer comprehensive solutions.

Also, with centralized behavior towards core insurance operations, insurance AI apps cluster the methods of reviewing and processing claims. This helps insurers to move in the right directions and determine anti-churn measures to map customer journeys.

- Accurate pricing & underwriting

Evaluating and pricing risk necessitates substantial study of the customer's risk profile. As a result, manual underwriting is time-consuming, prone to mistakes, and can result in wasteful pricing. This is why AI is a good match for underwriting and risk pricing operations.

Insurance AI is beneficial. Underwriters can automate data collecting, data extraction, form filling, and other repetitive processes. Underwriters can gain a better knowledge of the risk associated with client profiles by using insurance algorithms and other analytical tools.

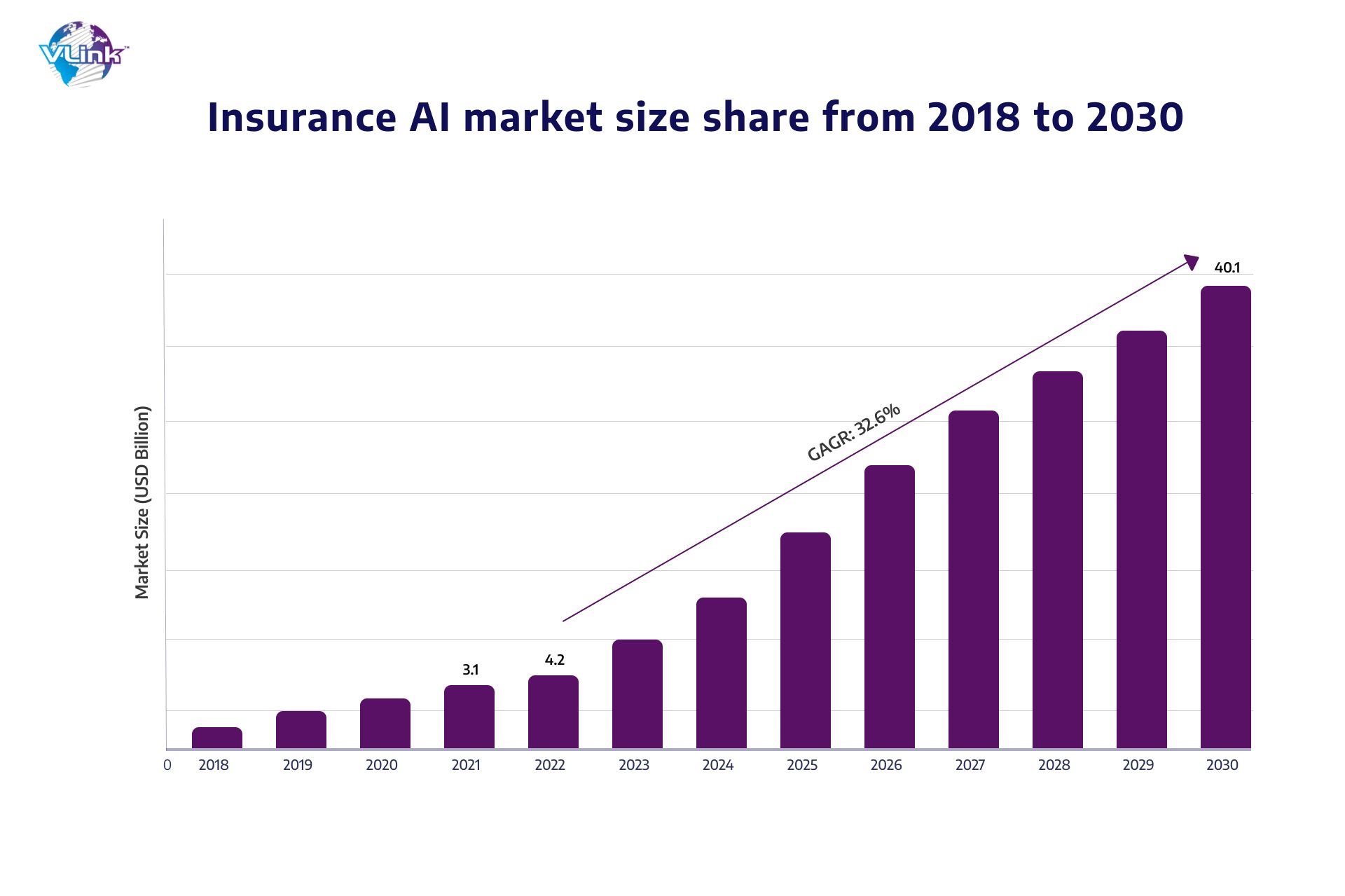

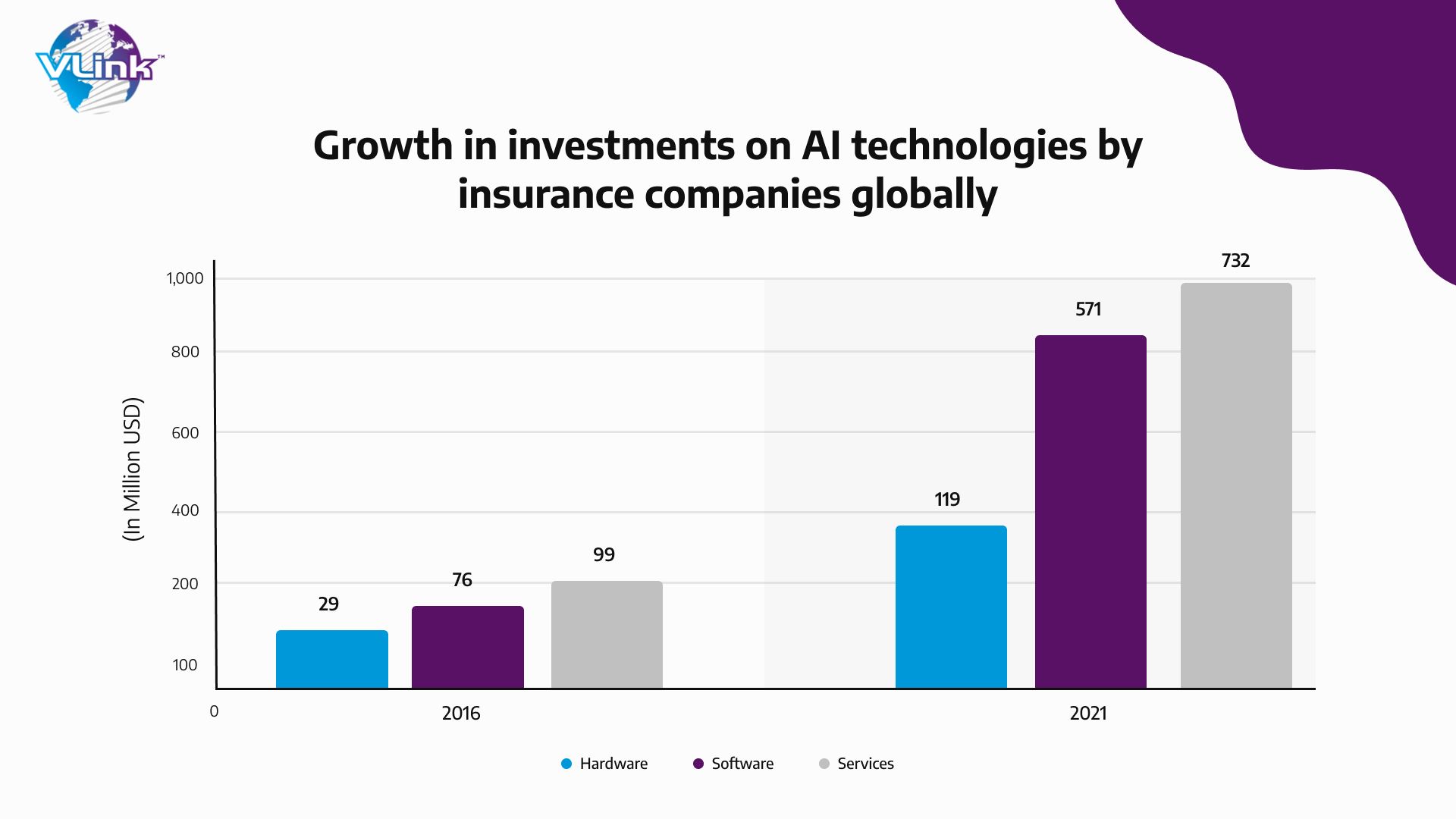

The use of AI has seen rapid growth in terms of advancing traditional systems. Here are some stats that show the rising share of these technologies in insurance sector:

Different Roles of AI in insurance sector: Policies-wise categorization & implementation

One of the major advantages that make artificial intelligence solutions limitless is that the smart algorithms can adapt human behavior and react accordingly. And this functional further transformed into conversational AI solutions.

The highly intelligent and personalized approach increases the customer’s confidence in the overall service, while improving the customer experience in the insurance industry.

Let’s see how insurance AI works for different policies:

1. AI In Healthcare Insurance

a. Faster Disease Detection: AI in healthcare insurance recognizes concerns and rapidly notifies care teams, allowing clinicians to explore choices, make faster treatment decisions, and ultimately save lives.

b. More Accuracy in Diagnosis: AI and ML (Machine Learning) in health insurance aid pathologists in making more accurate diagnosis and devising techniques of individualized therapy.

c. AI Is an Excellent Symptom Checker: Deploying a healthcare chatbot will listen to the patient's symptoms and health problems, then direct the patient to the proper care based on its diagnosis.

2. AI In Life Insurance

a. Marketing & Sales: A life insurance AI system can aid with customer segmentation, opportunity targeting, prospect qualification, product suggestion, and personalization.

b. Real-time Interaction: Non-renewal costs insurers money, and AI can predict the risk of turnover. Such forecasts can be used to calculate the renewal price change (RPC).

c. Individual Mortality Reserving: AI for life insurance claims can help you in figuring out individual mortality reserving, as well as individual persistence estimates and overall profitability and cash flow.

3. AI In Property Insurance

a. Risk Analysis and Underwriting: Using AI to analyze data can result in evaluation of prospective risks, a decision of the best policy and coverage for your needs, and strategies to lower your risk of future claims.

b. Fraud Detection: AI chatbots enable to automate various operations that are often prone to fraud and act without the need for human intervention. It can also detect new policies, helping in the identification of individuals who are more inclined to conduct insurance fraud.

c. Automated Claims Processing: AI can help customers in reporting a claim, recording damage or loss, verifying insurance and limitations, communicating with customers, and informing customers and insurers about the progress of claims.

4. AI In Vehicle Insurance

a. Production Predictive Analytics: The integration of AI in car production helps automakers cut manufacturing costs while also providing a safer and more efficient factory floor. It also aids in the prediction of automotive component failures.

b. Vehicle Maintenance Advice: AI and ML algorithms for car insurance firms aid in offering vehicle maintenance advice to drivers.

c. Driver Behavior Data: AI-powered auto insurance applications provide a wealth of useful in-car data. Cameras and infrared sensors can precisely assess the driver's behavior and send warning messages to help avoid accidents.

Insurers always keep an eye on what their customers expect from them, and how they can uplift their experience to serve them better. Integrating AI for different purposes helps them understand these factors well enough throughout the journey.

The progressive nature of insurance AI has led many popular brands to the new heights of success. They adapted to their potential audience's expectations, understood the competition to upgrade infrastructure, and integrated AI and its related technologies well.

Let’s have a look at:

Top Insurance Companies That Adopted AI Successfully

- Liberty Mutual – Insurance AI For Vehicle Claims

Liberty Mutual integrates artificial intelligence with the help of its venture Solaria Labs, which conducts research in fields such as computer vision and natural language processing.

One outcome of their efforts is Auto Damage Estimator. This AI program can swiftly assess car damage and generate repair estimates after an accident by doing comparison assessments of anonymous claims images.

- Allstate – Personalized AI Virtual Assistant

Allstate assists small company owners with ABIE ("Abbie"), an AI-powered technology that assists clients in locating crucial papers and answering queries via an onscreen avatar that can hold lifelike conversations with insurance agents.

ABIE can address what coverages work best for certain organizations, what occurrences each coverage covers, and more by utilizing contextual knowledge and intelligent content.

- ZestFinance – Automated risk management

ZestFinance integrated AI and machine learning to enable lenders assess risk and reach out to prospective new clients by leveraging a plethora of traditional and non-traditional data, such as unique credit score models, to make better forecasts. The ultimate objective is to assist firms in increasing underwriting profits while decreasing risk.

Also Read: https://www.vlinkinfo.com/blog/build-car-insurance-mobile-app-like-state-farm/

What the future holds for Insurance AI Apps?

Insurance is predicted to transition from "detect and repair" to "predict and prevent" during the next decade. Users are also becoming used to utilizing new technology to increase productivity, cut expenses, improve decision making, and increase customer happiness.

While AI adoption has been slow, it is already radically transforming the landscape. Insurance businesses that wish to stay competitive should experiment with AI. Following stats show the consistent adoption of AI technologies and will continue to grow by 2023:

Companies can prepare and remain competitive by designing their own algorithms to examine the impact of machine learning on their company.

An individual machine learning algorithm that does its analysis on its own is affordable, [and] in many circumstances, a standalone analysis tool is more than adequate.

How VLink can help you integrate AI in insurance applications

Artificial intelligence in insurance is poised to impact the industry's future. There are several AI platforms for insurance businesses on the market, each supported by AI-enabled insurance technologies that will assist insurers in managing duties efficiently and providing excellent customer service.

VLink is your dependable development partner, assisting you in reaping the benefits of automation in the insurance industry. With our experience in AI software development, we have assisted firms in effectively changing their company capabilities.

Furthermore, with the aid of conversational AI in banking, we can help businesses to manage over 50% of customer care enquiries through the use of chatbots, resulting in a 20% reduction in human expenses.

You can also tap into the experience of VLink’s dedicated team to take a leap into the future of insurance.

Rapid technological advancements in the coming decade will result in disruptive developments in the insurance business. Insurers that employ new technology to build novel solutions, harness cognitive learning insights from new data sources, streamline processes and cut costs, and meet consumer expectations for individualization and dynamic adaptation will be the winners in AI-based insurance.

Most importantly, carriers who adopt a mindset gathered on developing possibilities from disruptive technologies, rather than perceiving them as a threat to their existing company, will succeed in the insurance market in 2030.