The number of digital wallet users in the US is expected to grow by 53% from 2023 to 2026. So, investing in digital wallet app development is the right choice for business owners, whether small or large. It can be a lucrative business opportunity, but it requires careful planning and knowledge of mobile payment systems.

This blog will guide you through seven essential things about digital wallet app development and provide a comprehensive description of digital wallets, including their market stats, features, technologies, challenges, case studies, cost, and many more.

Let’s first start with its brief introduction!

What is a Digital Wallet App?

A digital wallet: An electronic version of your debit & credit cards that allows users to make payments digitally through smartphones and the Internet. Users can also access their financial information and quickly pay their bills. Plus, they can perform various activities, including mobile recharges, ticket booking, or other payments without carrying cash or credit cards.

Essential Things to Know About Building a Digital Wallet App

Here are several essential things you need to know about digital wallet app development before investing in this domain:

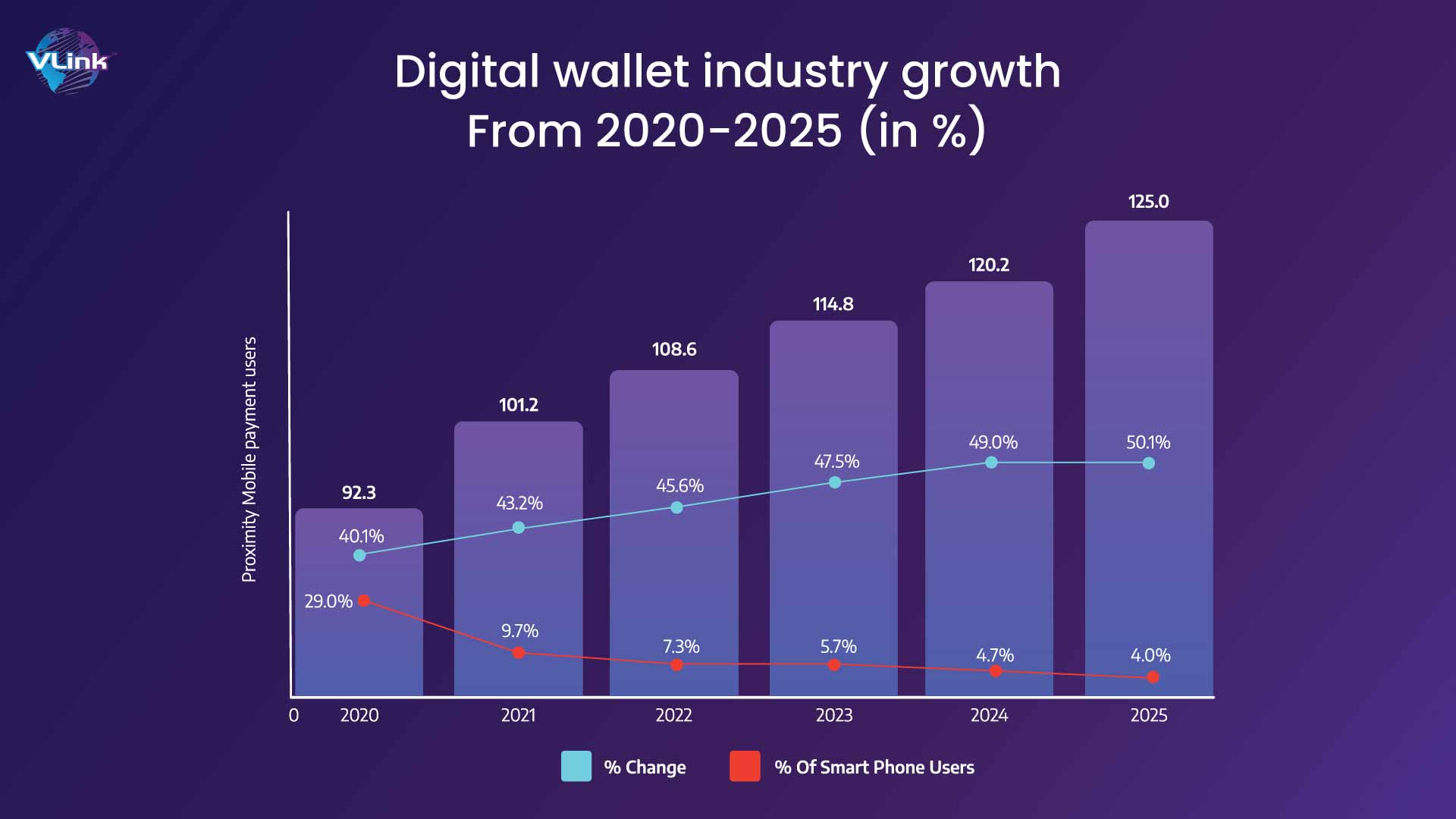

Market Statistics about Digital Wallet App Development

- The digital payment market volume is projected to reach USD15.17 trillion by 2027.

- Currently, 82% of US consumers use mobile digital payments.

- The United States has over 273.76 million phones capable of using digital wallet apps.

- The mobile wallet market is expected to grow at a CAGR of 25% through 2028.

- Between 2020 and 2025, the use of electronic transactions is anticipated to rise with a CAGR of 26.93%.

- The NFC market was valued at USD24.9 billion in 2023 and is projected to grow to USD50.2 billion by 2030, with a CAGR of 17.1% from 2024 to 2030.

Digital Wallet Industry Growth From 2020-2025

Key Features of Digital Wallet App Development

An eWallet app is divided into three panels: User, Admin, and Merchants, as shown in the image below.

Have a look at key features of digital wallet app development

User Authentication and Security

- Biometric Authentication & Two-Factor Authentication (2FA): Use of fingerprint or facial recognition for secure access.

- Encryption: Ensures that user data is securely transmitted and stored.

Seamless Transactions

- Multiple Payment Methods: Support for credit/debit cards, bank transfers, and other payment gateways.

- QR Code Payments: Enables quick and easy transactions through QR code scanning.

- NFC (Near Field Communication): Facilitates contactless payments.

Real-Time Notifications

- Transaction Alerts: Instant notifications for every transaction.

- Promotional Notifications: Updates on offers, discounts, and rewards.

Account Management

- Balance Overview: Real-time display of account balance and transaction history.

- Expense Tracking: Categorization and analysis of spending patterns.

Integration with Other Services

- Bank Account Linking: Connect multiple bank accounts for seamless transactions.

- Bill Payments: Facility to pay utility bills, recharge mobile phones, and other services.

- Loyalty Programs: Integration with loyalty programs and reward points.

Multi-Currency Support

- Currency Conversion: Automatic conversion of currencies for international transactions.

- Global Accessibility: Use the wallet app across different countries.

Advanced Features

- AI and Machine Learning: Personalized financial advice and fraud detection.

- Blockchain Technology: Enhanced security and transparency in transactions.

Compliance and Regulatory Adherence

- KYC (Know Your Customer): Compliance with legal and regulatory requirements.

- GDPR Compliance: Ensures users' data protection and privacy.

Cross-Platform Compatibility

- iOS and Android Support: Availability on major mobile operating systems.

- Web Interface: Access through web browsers for added convenience.

By incorporating these features, digital wallet apps can provide a comprehensive, secure, and user-friendly experience for managing finances. If you're looking to hire digital wallet app development experts for your project and are unsure how to find and hire FinTech developers, VLink is the right IT staffing agency in the United States.

Technologies or Tech Stacks Used in eWallet App Development

Developing a digital wallet or eWallet app involves utilizing a range of technologies to ensure security, usability, and scalability. Here are some of the critical technologies and tech stacks used in eWallet app development:

| Category | Technologies Used in eWallet App |

| Frontend Technologies | React Native, Flutter, Swift, Kotlin, HTML, CSS, JavaScript |

| Backend Technologies | Node.js, Django, Ruby on Rails, Spring Boot, .NET Core |

| Database Management | MySQL, PostgreSQL, MongoDB, Firebase |

| Security Technologies | Encryption (AES, RSA), OAuth2, Two-Factor Authentication (2FA), Tokenization, SSL/TLS |

| Payment Gateway Integration | PayPal SDK, Stripe API, Braintree, Square, Adyen |

| Blockchain Technologies | Ethereum, Hyperledger |

| APIs and SDKs | RESTful APIs, SDKs for third-party services integration (e.g., Google Pay, Apple Pay) |

| Cloud Services | AWS, Google Cloud Platform, Microsoft Azure |

| Development Tools | Git, Jenkins, Docker, Kubernetes |

| Testing Tools | Selenium, Appium, JUnit, Postman |

These technologies are combined to create a secure, reliable, and user-friendly digital wallet app that meets the needs of modern users.

Security Compliances for digital wallet application development

When building a secure eWallet app, it’s essential to consider following security compliances to protect users’ personal & financial data.

Compliance with Data Privacy Regulations

Mobile wallet app programmers must comply with relevant data privacy regulations.

- General Data Protection Regulation (GDPR)

- California Consumer Privacy Act (CCPA)

Secure Login & Authentication

Make sure to include strong encryption in your mWallet app development to protect users’ sensitive information, such as credentials, passwords, etc. You can also integrate multifactor authentication for an additional layer of security.

Secure Data Transmission

Encryption of all data transmissions between the app and server can enhance the security of communication. For this, you need to integrate your mobile payment apps with secure communication channels such as SSL/TLS.

Protection Against Fraud

mWallet app development must involve features that detect and prevent deceptive activities such as unauthorized access and reporting suspicious activity.

Secure Data Storage

A well-designed and robust mWallet app can securely store user data and financial information, utilizing secure storage technologies such as encryption and hashing.

Compliance with PCI-DSS

The app must comply with PCI-DSS (Payment Card Industry Data Security Standards) standards to ensure the secure processing of physical card details.

Regular Security Audits & Updates

Digital wallets should go through regular security audits to identify vulnerabilities and implement timely security updates.

Considering these security compliances, you can create a secure and reliable eWallet or mobile Wallet app to gain user confidence.

Case Study & Use Cases of Digital Wallet App Development

Here are five successful case studies and use cases of digital wallet app development:

Apple Pay

Apple Pay revolutionized mobile payments by integrating seamless, secure payment methods directly into iPhones. Utilizing NFC technology and biometrics, Apple Pay allows users to make payments in-store, online, and within apps.

Key Success Factors:

- Security: Use of biometric authentication and tokenization.

- User Experience: Simple and intuitive interface.

- Integration: Wide acceptance across retailers and online platforms.

- Brand Trust: Leveraging Apple's strong brand reputation.

Venmo

Venmo, owned by PayPal, became popular among millennials for its social feed feature, which allows users to share and comment on transactions. It is primarily used for peer-to-peer payments, making splitting bills and sharing expenses easier.

Key Success Factors:

- Social Integration: Unique social feed feature.

- Ease of Use: Simple, user-friendly interface.

- Network Effect: Popular among younger demographics.

- Integration: Easy integration with bank accounts and credit cards.

Alipay

Alipay, part of the Alibaba Group, started as an escrow service for Alibaba’s e-commerce platforms and evolved into a comprehensive digital wallet. It now supports payments, investments, and money transfers and is widely used in China.

Key Success Factors:

- Comprehensive Services: Wide range of financial services.

- Integration: Seamless integration with Alibaba’s e-commerce platforms.

- User Trust: Strong brand association with Alibaba.

- Innovation: Constantly adding new features and services.

Google Pay

Google Pay, formerly Android Pay, integrated multiple Google services into one platform. It allowed users to pay for purchases in stores, online, and within apps. It also introduced features like splitting bills and sending money to friends.

Key Success Factors:

- Integration: Seamless integration with other Google services.

- Security: Strong security features, including tokenization.

- Ease of Use: Intuitive and user-friendly design.

- Global Reach: Availability in multiple countries and regions.

PayPal

PayPal, one of the pioneers in digital payments, has evolved from a simple payment gateway to a comprehensive digital wallet solution. Initially known for facilitating online transactions, PayPal has expanded its services to include peer-to-peer payments, in-store payments, and financial services like credit and lending.

Key Success Factors:

- Trust and Security: Strong focus on transaction security and buyer protection, building trust among users and merchants.

- Global Reach: Support transactions in multiple currencies and countries.

- Versatility: Wide range of services, including online payments, peer-to-peer transfers, and in-store payments.

- Integration: Seamless integration with e-commerce platforms

- Innovative Features: cryptocurrency transactions, PayPal Credit, and integration with other financial services.

These case studies highlight how digital wallet apps have successfully integrated advanced technology, security features, and user-friendly interfaces to become essential tools for financial transactions.

Challenges of eWallet App Development

Developing an eWallet app comes with its own set of challenges. Here are five main challenges that developers often face:

- Security Concerns: It is paramount to ensure robust security measures to protect user data, transactions, and privacy. This includes encryption, secure authentication methods, and protection against hacking and fraud.

- Regulatory Compliance: Adhering to financial regulations and compliance standards can be complex and varies by region. Developers must navigate these requirements to ensure the legal operation of the eWallet app.

- Scalability: As the user base grows, the app must handle increased transactions and data without compromising performance. Scalability challenges include backend infrastructure, database management, and load balancing.

- User Experience: Designing a seamless and intuitive user interface is crucial for user adoption and retention. This involves balancing simplicity with functionality, optimizing for various devices, and providing responsive customer support.

- Integration with Payment Systems: Integrating with diverse payment gateways, banks, and financial institutions requires technical expertise and coordination. Compatibility issues, transaction synchronization, and API management are common challenges.

Addressing these challenges requires a combination of technical expertise, strategic planning, and adherence to industry best practices.

Cost of Building a Digital Wallet App

Organizations thinking of secure digital wallet app development services need to contact a software development company experienced in FinTech software development company.

The average cost to build an electronic wallet app is often between $20,000 and $500,000.

But, if you want an advanced app with complex functionality like Apple Pay, you should expect to pay upwards of $80,000 to $150,000.

Cost to build a crypto wallet app or mWallet for Android may range between $20,000 and $50,000.

Conversely, the development cost of a mobile wallet app for the iOS platform may range between $25,000 and $55,000.

Accurate eWallet app development cost depends on different parameters, including features, business, and service types. The app's features and functionalities and development style and stages also affect the price of creating a mobile wallet or digital wallet app.

It`s best to consider different factors to determine the average cost of mobile wallet development.

The Final Thought!

By following these essential things about digital wallet app development, you can bring your imaginative eWallet into reality. It requires proper planning, strategies, and experience. So, it would be better to partner with a FinTech software development company. They will help you build a secure & user-friendly mWallet app for your business.

Build your Next Digital Wallet App with VLink

Transform your vision into reality with VLink, your trusted partner for digital wallet app development. Whether you're launching a peer-to-peer payment platform, integrating cryptocurrency wallets, or enhancing financial inclusion with seamless transactions, VLink delivers robust financial solutions customized to your needs.

Why Choose VLink for your electronic wallet app development project?

- Expertise: Leverage our deep industry knowledge and technical proficiency in digital wallet app development.

- Custom Solutions: Personalized development to match your unique business requirements and user expectations.

- Security: Implement cutting-edge security protocols to safeguard user data and transactions.

- Scalability: Ensure your app grows seamlessly with your user base and business expansion.

- Support: Dedicated support throughout the development lifecycle and beyond.

Contact us to discuss how VLink can accelerate your digital wallet app project from concept to launch. Let's innovate together.

Frequently Asked Questions

You can integrate your digital wallet app with other payment systems for different payment options. Contact VLink to ensure seamless integration and proper security measures.

The time it takes to develop eWallet depends on the complexity of the app’s features, security level, and other factors. Usually, a well-designed digital wallet app can take 4-12 months.

Digital wallet apps include:

- Payment Wallets: Facilitate transactions.

- Crypto Wallets: Store cryptocurrencies.

- Retail Wallets: Loyalty and rewards.

- P2P Wallets: Transfer funds between individuals.

Five use cases of digital wallet apps include:

- Contactless Payments: Tap-to-pay in stores.

- Bill Payments: Manage utility bills.

- Money Transfers: Instant peer-to-peer transfers.

- Rewards Programs: Earn and redeem points.

- Ticketing: Purchase and store event tickets.

VLink is the best IT staffing agency where you can hire developers with expertise in Fintech domains to build your mobile wallet app. We guarantee quality, speed, flexibility, and stability with our top 3% of tech talent.

To build a digital wallet app, follow these steps:

- Define Requirements: Identify features like payments, security, and user interface.

- Design UX/UI: Create intuitive navigation and secure transactions.

- Develop Backend: Build robust server-side infrastructure.

- Integrate Payment Gateways: Ensure seamless transactions.

- Test and Launch: Conduct thorough testing and release the app.