Loan management processes can be complex and time-consuming, with various challenges such as:

- Long loan apps

- Manual verification

- Poor customer experience

- Multiple applications management

- Lack of growth

The US Small Business Administration states that more than 50% of small business loan applications are rejected due to insufficient documentation and ineffective loan management procedures.

A separate study by the Financial Conduct Authority revealed that nearly 40% of loan requests experience delays due to incomplete or incorrect information in the applications.

From keeping track of payments and interest rates to managing the loan administration, it can be complicated to stay organized and ensure everything runs smoothly. This is where the loan management system comes in.

Software for loan management streamlines the credit management process, automates the loan processing stages, and gives a holistic view of product performance.

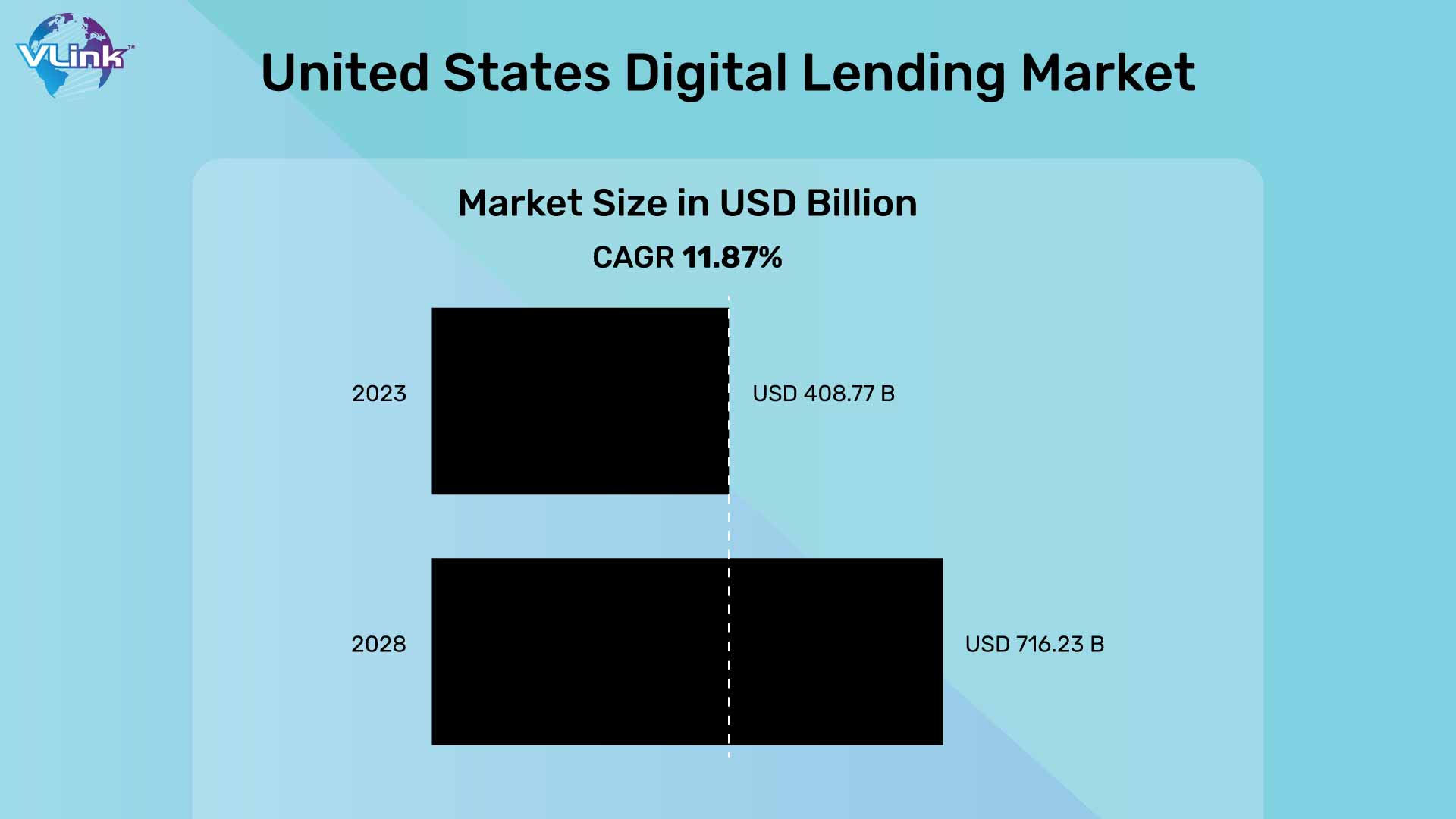

As digital transformation accelerates, the adoption of loan management software is expanding at a rapid rate. The global loan management software market was valued at $5.9 billion in 2021 and is projected to reach $29.9 billion by 2031, growing at a CAGR of 17.8% from 2022 to 2031.

If you want to build loan management software for your small business, you are at the right place! In this blog, you will learn everything you need to know about “how to build a loan management system”.

Let’s first start with its brief introduction.

What is Loan Management Software?

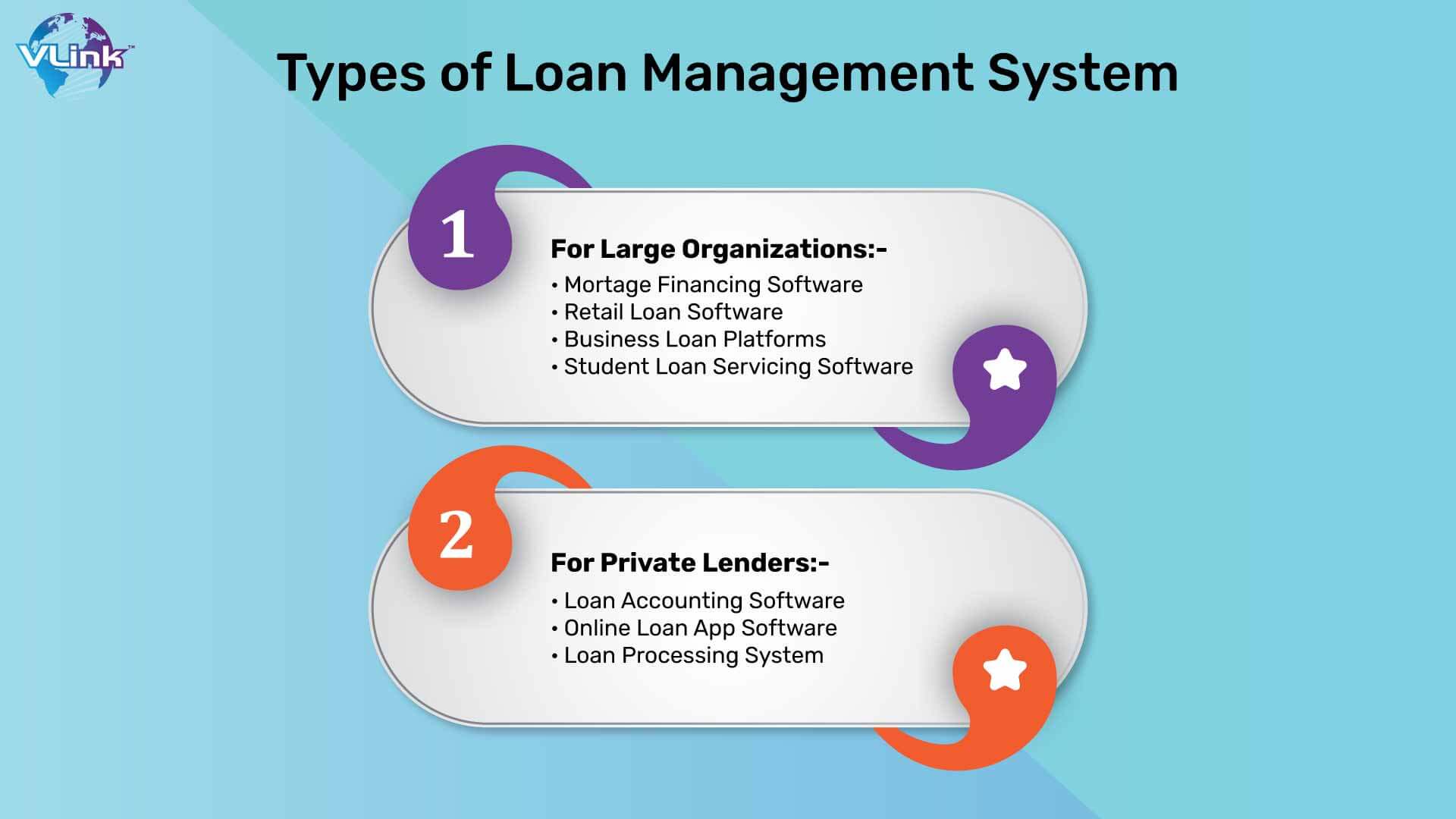

Loan management software helps lenders and borrowers automate every stage of loan handling processes, from loan app to repayment to closing. It also enables credit unions, banks, mortgage lenders, and other financial institutions to;

- Collect and verify customer data faster

- Offer new loan products

- Manage the current products

- Calculate interest rates

- Determine the loan return capabilities

In addition, this software comes with the latest tech stack that makes the process of consumer lending easier. Lenders can generate reports with detailed analytics and get critical insights a lot easier and more efficiently for lenders.

Types of loan management systems are shown below image:

Why would Buyers invest in a Loan Management System?

The lending software market’s potential growth has been set through businesses' ongoing digital transformation, featuring increasingly strict regulatory demands. It compels financial institutions to build loan tech software to manage increasing workloads and address regulatory complexities.

Regarding loan software market share by region, North America is becoming more popular than other countries. With gross mortgage value reaching $74.8bn in 2023, investing in mortgage app development makes perfect sense for lenders based in the US.

According to McKinsey, a customer experience revolutionization drives:

- up to a 30% uplift in customer satisfaction,

- up to 20% improvement in employee satisfaction and

- up to a 50% increase in revenue.

Top reasons why buyers should invest in loan management software are shown in the image below:

Must-Have Features for Loan Management System

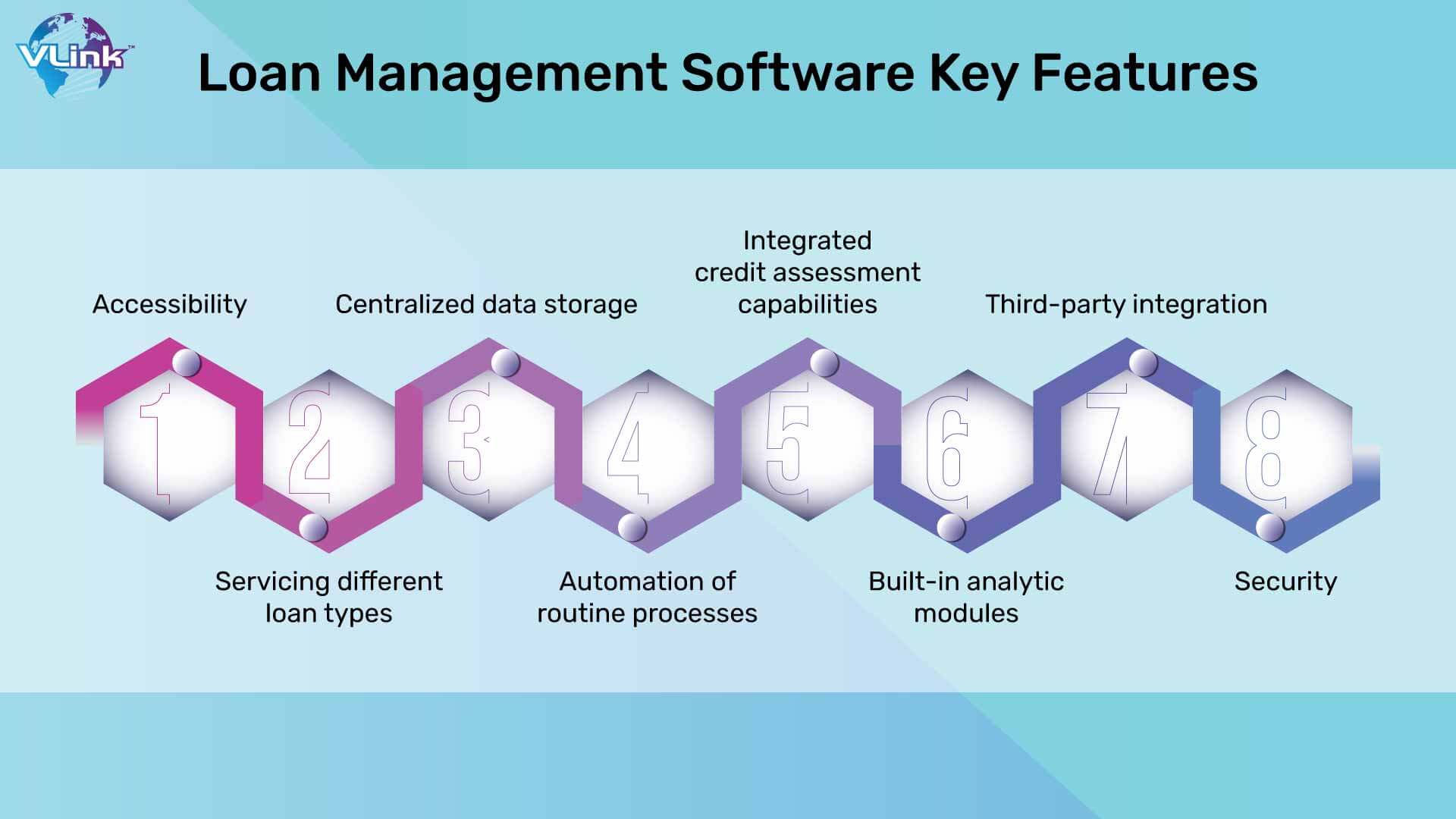

Accessibility

An enterprise that wants to create loan software may need more on-premises infrastructure capabilities for its non-disruptive operation, updates, and support. Using this software is the best to ensure optimal scalability and availability.

Servicing different loan types

Money lending software is capable of servicing different types of loans in a better way. Lending apps with a wide range of use cases will surely grab the attention of more users than a system targeting only one specific loan type.

Centralized data storage

Every stage of the loan handling process includes working with customer data. The best lending software stores information in centralized storage accessible during every loan processing stage.

Automation of routine processes

Robotic process automation allows lenders to streamline simple rule-based processes through loan management platforms. It accelerates loan origination and processing and accounts for enhancing client satisfaction. In addition, it helps to reduce human error.

Integrated credit assessment capabilities

Innovative loan servicing software for private lenders can instantly connect with credit bureaus for credibility assessment. Such platforms must receive regular credit data updates and leverage extensive data analytics services to assess applicants’ trustworthiness.

Built-in analytic modules

Another critical feature of outstanding loan servicing software for lenders is leveraging machine learning & AI services and big data. It not only generates reports but also enables organizations to identify market trends. On top of that, it detects patterns in customer behavior and comes up with the latest products.

Third-party integration

Loan management systems can integrate with other enterprise software. This feature attracts most organizations towards money lending processing apps.

ERP and CRM solutions can enrich the loan system with data and insights. Software-integrated lending modules with software for remote sales personnel are also popular among lenders and borrowers.

Also Learn: what ERP is and why you should invest in it.

Security

Financial services work with susceptible data; for both lenders and customers, security is a matter of paramount importance. An excellent lending system should include and ensure the highest level of customer, data, and network protection.

How to design and develop loan management software?

Loan management software design & development solutions can be complex and challenging. But, with the right approach, you can build software for money lending process easily. Here are a few tips that will help you optimize the design and development process.

Analyze your market

Start by analyzing your market to identify your requirements, such as features, functionalities, target audience, and other specific business needs.

Hire experienced developers

Consider hiring experienced developers for your loan management software development project. They will design & build software for loan management with the latest technology without any hassle.

Also Read: how to find & hire FinTech app developers.

Choose the right technology stack

Pick the right tech stack for your project, considering your dedicated development team's specific requirements, skills, and expertise.

Work with a user-centered design approach

A user-centered design approach keeps user experience a top priority. It will help ensure that end-users find an easy-to-use and intuitive solution.

Focus on security and compliance

In this stage of building loan management software, it is imperative to immediately incorporate security and compliance measures.

By following these tips, you can optimize your design and development process. You will be able to build high-performance loan management software that meets your needs and requirements.

How much does it cost to build a loan management system?

The cost of an experienced financial software development company with expertise in building loan management software can be around $60,000 and $80,000.

If you partner with a development firm in Australia or the US, they will charge an average price of $100-$120. The same will come down to $60-$80 when you partner with an agency in India.

This makes your loan management app development costs anywhere between $60,000 to $80,000.

Also Learn: how much does it cost to build a successful mobile app for your business.

Contact VLink for Loan Management Software Development!

In the end, it’s essential for lending businesses to know the digital lending space is growing in popularity, which parallels the rising demand for customer satisfaction.

So, if you want to turn your lending firms to digital with high-quality loan management software, we can help!

VLink has Expertise in financial services, and our fintech experts know how to build loan management software for your business. Also, we ensure you can make better business decisions and better customer response time through our loan management software. Our experienced developers help lenders meet the needs of tomorrow’s borrowers.

Contact us to set off your digital loan management journey!

Frequently Asked Questions

Loan management software improves the lending experience by streamlining and automating loan processes. It reduces paperwork, speeds up application processing, and enhances accuracy in decision-making.

Borrowers benefit from quicker approvals and easier access to loans, while lenders can efficiently manage loan portfolios, reducing risks and improving customer service.

Overall, it enhances efficiency, transparency, and convenience in lending, resulting in a better experience for borrowers and lenders.

Some of the best loan management software tools are:

- LoanPro: Offers a comprehensive solution for loan servicing and management.

- Northridge Loan System: It's ideal for various loan types and servicing needs.

- Shaw Systems: It's known for its flexibility in managing complex loan portfolios.

- TurnKey Lender: Offers AI-powered lending solutions.

- Calyx Point: Focuses on mortgage loan management.

The best choice depends on specific lending needs and preferences.

Loan management software offers numerous benefits, including.

- Streamlined processes

- Reduced administrative tasks

- Improved accuracy in loan origination and servicing

It enhances the borrower experience by enabling online applications and faster approvals. Lenders benefit from better risk assessment, automated payment processing, and improved compliance.

Overall, it boosts efficiency, reduces operational costs, and enhances decision-making, making it an invaluable tool for lenders and borrowers.